Q3 2019 Financial Highlights:

- Revenue: $7.2 billion

- Gross Margins: 33.9%, up 340 basis points from the prior-year period

-

Diluted Net Earnings Per Share:

- GAAP ($0.02), includes ($0.42) adjustment for a one-time arbitration award to DXC, compared to the previously provided outlook of $0.29 to $0.33 per share

- Non-GAAP $0.45, up 7% from the prior-year period EPS and above the previously provided outlook of $0.40 to $0.44 per share

- Cash Flow from Operations: $1.2 billion, and $2.6 billion year-to-date, up $927 million from the prior-year-to-date period

- Free Cash Flow: $648 million, and $860 million year-to-date, up $790 million from the prior-year-to-date period

FY 2019 Outlook:

- Earnings Per Share: Adjusting GAAP diluted net earnings per share outlook to $0.65 to $0.69 due to a one-time arbitration award to DXC and raising non-GAAP diluted net earnings per share outlook to $1.72 to $1.76

- Free Cash Flow: Reiterating free cash flow guidance of $1.4 to $1.6 billion

SAN JOSE, Calif. — (BUSINESS WIRE) — August 27, 2019 — Hewlett Packard Enterprise (NYSE: HPE) today announced financial results for its fiscal 2019 third quarter, ended July 31, 2019.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190827005771/en/

HPE Q3 FY19 Earnings Results Infographic

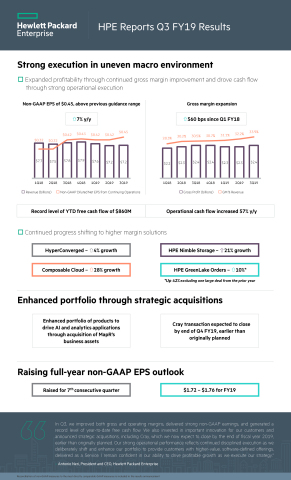

“In Q3, we improved both gross and operating margins, delivered strong non-GAAP earnings, and generated a record level of year-to-date free cash flow,” said Antonio Neri, president and CEO of Hewlett Packard Enterprise. “We also invested in important innovation for our customers and announced strategic acquisitions, including Cray, which we now expect to close by the end of fiscal year 2019, earlier than originally planned.”

“Our strong operational performance reflects continued disciplined execution as we deliberately shift and enhance our portfolio to provide customers with higher-value, software-defined offerings, delivered as a Service,” added Neri. “I remain confident in our ability to drive profitable growth as we execute our strategy.”

Third Quarter Fiscal Year 2019

HPE fiscal 2019 third quarter continuing operations financial |

||||||

performance |

||||||

|

Q3 FY19 |

Q3 FY18 |

Y/Y |

|||

GAAP net revenue ($B) |

$7.2 |

|

$7.8 |

|

(7.0%) |

|

GAAP operating margin |

(1.1%) |

|

6.3% |

|

(7.4 pts.) |

|

GAAP net earnings ($B) |

($0.0) |

|

$0.5 |

|

(106%) |

|

GAAP diluted net earnings per share |

($0.02) |

|

$0.29 |

|

(107%) |

|

Non-GAAP operating margin |

9.9% |

|

9.1% |

|

0.8 pts. |

|

Non-GAAP net earnings ($B) |

$0.6 |

|

$0.6 |

|

(5.6%) |

|

Non-GAAP diluted net earnings per share |

$0.45 |

|

$0.42 |

|

7.1% |

|

Cash flow from operations ($B) |

$1.2 |

|

$1.2 |

|

(4.2%) |

|

Information about HPE’s use of non-GAAP financial information is provided under “Use of non-GAAP financial information” below.

Financial Summary

Third quarter net revenue of $7.2 billion, down 7% from the prior-year period, and down 3% from the prior-year period, excluding Tier 1 server sales and adjusted for currency.

Third quarter gross margins of 33.9%, up 340 basis points from the prior-year period.

Third quarter GAAP diluted net earnings per share (“EPS”) from continuing operations was ($0.02), includes ($0.42) adjustment for a one-time arbitration award to DXC, compared to GAAP diluted net EPS from continuing operations of $0.29 in the prior-year period.

Third quarter non-GAAP diluted net EPS $0.45, up from non-GAAP diluted net EPS of $0.42 in the prior-year period. Third quarter non-GAAP net earnings and non-GAAP diluted net EPS exclude after-tax adjustments of $630 million and $0.47 per diluted share, respectively, primarily related to the impact of acquisition, disposition and other related charges, transformation costs, tax indemnification adjustments, and adjustments for taxes.

Third quarter cash flow from operations of $1.2 billion, and $2.6 billion year-to-date, up $927 million from the prior-year-to-date period.

Free cash flow of $648 million, and $860 million year-to-date, up $790 million from the prior-year-to-date period.

Segment Results

- Intelligent Edge revenue was $762 million, with 4.9% operating margin. HPE Aruba product revenue was down 4% year over year when adjusted for currency and HPE Aruba Services revenue was up 16% year over year when adjusted for currency.

- Hybrid IT revenue was $5.5 billion, with 12.7% operating margin, up 250 bps year over year. Mix-shift continues towards HPE’s higher-margin value products with revenue from High-Performance Compute up 2% year over year when adjusted for currency, Composable Cloud up 28% year over year when adjusted for currency, and Hyperconverged Infrastructure showing continued momentum, up 4% year over year when adjusted for currency. HPE Nimble Storage was up 21% year over year when adjusted for currency. HPE Pointnext operational services orders and Nimble services orders were up 3% year over year when adjusted for currency.

- Financial Services revenue was $888 million, with 8.7% operating margin, up 90 bps year over year. Net portfolio assets were up 2% year over year when adjusted for currency, and financing volume was up 5% year over year when adjusted for currency. The business delivered return on equity of 15.8%, up 350 bps from the prior-year period.

FY2019 GAAP Outlook

For the fiscal 2019 fourth quarter, Hewlett Packard Enterprise estimates GAAP diluted net EPS to be in the range of $0.24 to $0.28. For fiscal 2019 full-year Hewlett Packard Enterprise now estimates GAAP diluted net EPS to be in the range of $0.65 to $0.69 due to a one-time arbitration award to DXC.

Raised FY2019 Non-GAAP Outlook

For the fiscal 2019 fourth quarter, Hewlett Packard Enterprise estimates non-GAAP diluted net EPS to be in the range of $0.43 to $0.47. Fiscal 2019 fourth quarter non-GAAP diluted net EPS estimates exclude after-tax costs of approximately $0.19 per diluted share, primarily related to transformation costs and the amortization of intangible assets.

For fiscal 2019 full-year, Hewlett Packard Enterprise now estimates non-GAAP diluted net EPS to be in the range of $1.72 to $1.76. Fiscal 2019 non-GAAP diluted net EPS estimates exclude after-tax costs of approximately $1.07 per diluted share, primarily related to acquisition, disposition, and other related charges, transformation costs, an adjustment to earnings from equity interest, and the amortization of intangible assets.

FY2019 Free Cash Flow Outlook

For fiscal 2019 full-year, Hewlett Packard Enterprise reiterates free cash flow guidance range of $1.4 to $1.6 billion, up over 35% at the mid-point from the prior year.

Hewlett Packard Enterprise provides certain guidance on a non-GAAP basis, as the company cannot predict some elements that are included in reported GAAP results. Refer to the discussion of non-GAAP financial measures below for more information.

About Hewlett Packard Enterprise

Hewlett Packard Enterprise is a global technology leader focused on developing intelligent solutions that allow customers to capture, analyze and act upon data seamlessly from edge to cloud. HPE enables customers to accelerate business outcomes by driving new business models, creating new customer and employee experiences, and increasing operational efficiency today and into the future.

Use of non-GAAP financial information

To supplement Hewlett Packard Enterprise’s condensed consolidated financial statement information presented on a generally accepted accounting principles (GAAP) basis, Hewlett Packard Enterprise provides revenue on a constant currency basis as well as non-GAAP operating expense, non-GAAP operating profit, non-GAAP operating margin, non-GAAP income tax rate, non-GAAP net earnings from continuing operations, non-GAAP net earnings from discontinued operations, non-GAAP diluted net earnings per share from continuing operations, non-GAAP diluted net earnings per share from discontinued operations, gross cash, free cash flow, net capital expenditures, net debt, net cash, operating company net debt and operating company net cash financial measures. Hewlett Packard Enterprise also provides forecasts of non-GAAP diluted net earnings per share and free cash flow. A reconciliation of adjustments to GAAP financial measures for this quarter and prior periods is included in the tables below or elsewhere in the materials accompanying this news release. In addition, an explanation of the ways in which Hewlett Packard Enterprise’s management uses these non-GAAP measures to evaluate its business, the substance behind Hewlett Packard Enterprise’s decision to use these non-GAAP measures, the material limitations associated with the use of these non-GAAP measures, the manner in which Hewlett Packard Enterprise’s management compensates for those limitations, and the substantive reasons why Hewlett Packard Enterprise’s management believes that these non-GAAP measures provide useful information to investors is included under “Use of non-GAAP financial measures” further below. This additional non-GAAP financial information is not meant to be considered in isolation or as a substitute for revenue, operating profit, operating margin, net earnings from continuing operations, net earnings from discontinued operations, diluted net earnings per share from continuing operations, diluted net earnings per share from discontinued operations, cash, cash equivalents and restricted cash, cash flow from operations, investments in property, plant and equipment, or total company debt prepared in accordance with GAAP.

Forward-looking statements

This press release contains forward-looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the results of Hewlett Packard Enterprise may differ materially from those expressed or implied by such forward-looking statements and assumptions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including but not limited to any projections of revenue, margins, expenses, effective tax rates, the impact of the U.S. Tax Cuts and Jobs Act of 2017, net earnings, net earnings per share, cash flows, benefit plan funding, deferred tax assets, share repurchases, currency exchange rates or other financial items; any projections of the amount, timing or impact of cost savings or restructuring charges; any statements of the plans, strategies and objectives of management for future operations, as well as the execution of corporate transactions or contemplated acquisitions, transformation and restructuring plans and any resulting benefit, cost savings, revenue or profitability improvements; any statements concerning the expected development, performance, market share or competitive performance relating to products or services; any statements regarding current or future macroeconomic trends or events and the impact of those trends and events on Hewlett Packard Enterprise and its financial performance; any statements regarding pending investigations, claims or disputes; any statements of expectation or belief; and any statements or assumptions underlying any of the foregoing.

Risks, uncertainties and assumptions include the need to address the many challenges facing Hewlett Packard Enterprise’s businesses; the competitive pressures faced by Hewlett Packard Enterprise’s businesses; risks associated with executing Hewlett Packard Enterprise’s strategy; the impact of macroeconomic and geopolitical trends and events; the need to manage third-party suppliers and the distribution of Hewlett Packard Enterprise’s products and the delivery of Hewlett Packard Enterprise’s services effectively; the protection of Hewlett Packard Enterprise’s intellectual property assets, including intellectual property licensed from third parties and intellectual property shared with its former Parent; risks associated with Hewlett Packard Enterprise’s international operations; the development and transition of new products and services and the enhancement of existing products and services to meet customer needs and respond to emerging technological trends; the execution and performance of contracts by Hewlett Packard Enterprise and its suppliers, customers, clients and partners; the hiring and retention of key employees; execution, integration and other risks associated with business combination and investment transactions; and the execution, timing and results of any transformation or restructuring plans, including estimates and assumptions related to the cost (including any possible disruption of Hewlett Packard Enterprise's business) and the anticipated benefits of the transformation and restructuring plans; the effects of the U.S. Tax Cuts and Jobs Act and related guidance and regulations; the resolution of pending investigations, claims and disputes; and other risks that are described in Hewlett Packard Enterprise’s Annual Report on Form 10-K for the fiscal year ended October 31, 2018.

As in prior periods, the financial information set forth in this press release, including tax-related items, reflects estimates based on information available at this time. While Hewlett Packard Enterprise believes these estimates to be reasonable, these amounts could differ materially from reported amounts in the Hewlett Packard Enterprise Quarterly Report on Form 10-Q for the third quarter ended July 31, 2019. Hewlett Packard Enterprise assumes no obligation and does not intend to update these forward-looking statements.

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES |

||||||||||||

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS |

||||||||||||

(Unaudited) |

||||||||||||

(In millions, except per share amounts) |

||||||||||||

|

|

|||||||||||

|

Three months ended |

|||||||||||

|

July 31,

|

|

April 30,

|

|

July 31,

|

|||||||

Net revenue(a) |

$ |

7,217 |

|

|

$ |

7,150 |

|

|

$ |

7,764 |

|

|

Costs and expenses: |

|

|

|

|

|

|||||||

Cost of sales |

4,768 |

|

|

4,845 |

|

|

5,399 |

|

||||

Research and development |

481 |

|

|

457 |

|

|

435 |

|

||||

Selling, general and administrative |

1,253 |

|

|

1,214 |

|

|

1,221 |

|

||||

Amortization of intangible assets |

58 |

|

|

69 |

|

|

72 |

|

||||

Restructuring charges |

— |

|

|

— |

|

|

(1 |

) |

||||

Transformation costs |

170 |

|

|

54 |

|

|

126 |

|

||||

Disaster charges |

— |

|

|

(7 |

) |

|

— |

|

||||

Acquisition, disposition and other related charges(b) |

563 |

|

|

84 |

|

|

24 |

|

||||

Separation costs |

— |

|

|

— |

|

|

(2 |

) |

||||

Total costs and expenses |

7,293 |

|

|

6,716 |

|

|

7,274 |

|

||||

(Loss) earnings from continuing operations |

(76 |

) |

|

434 |

|

|

490 |

|

||||

Interest and other, net |

(70 |

) |

|

(18 |

) |

|

(64 |

) |

||||

Tax indemnification adjustments(c) |

(134 |

) |

|

4 |

|

|

2 |

|

||||

Non-service net periodic benefit credit(d) |

12 |

|

|

17 |

|

|

26 |

|

||||

Earnings from equity interests |

3 |

|

|

3 |

|

|

11 |

|

||||

(Loss) earnings from continuing operations before taxes |

(265 |

) |

|

440 |

|

|

465 |

|

||||

Benefit (provision) for taxes(e) |

238 |

|

|

(21 |

) |

|

(13 |

) |

||||

Net (loss) earnings from continuing operations |

(27 |

) |

|

419 |

|

|

452 |

|

||||

Net loss from discontinued operations |

— |

|

|

— |

|

|

(1 |

) |

||||

Net (loss) earnings |

$ |

(27 |

) |

|

$ |

419 |

|

|

$ |

451 |

|

|

Net (loss) earnings per share: |

|

|

|

|

|

|||||||

Basic |

|

|

|

|

|

|||||||

Continuing operations |

$ |

(0.02 |

) |

|

$ |

0.31 |

|

|

$ |

0.30 |

|

|

Discontinued operations |

— |

|

|

— |

|

|

— |

|

||||

Total basic net (loss) earnings per share |

$ |

(0.02 |

) |

|

$ |

0.31 |

|

|

$ |

0.30 |

|

|

Diluted |

|

|

|

|

|

|||||||

Continuing operations |

$ |

(0.02 |

) |

|

$ |

0.30 |

|

|

$ |

0.29 |

|

|

Discontinued operations |

— |

|

|

— |

|

|

— |

|

||||

Total diluted net (loss) earnings per share |

$ |

(0.02 |

) |

|

$ |

0.30 |

|

|

$ |

0.29 |

|

|

Cash dividends declared per share |

$ |

0.1125 |

|

|

$ |

0.1125 |

|

|

$ |

0.1125 |

|

|

Weighted-average shares used to compute net earnings per share: |

|

|

|

|

|

|||||||

Basic |

1,334 |

|

|

1,367 |

|

|

1,513 |

|

||||

Diluted |

1,334 |

|

|

1,382 |

|

|

1,531 |

|

||||

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES |

||||||||

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS |

||||||||

(Unaudited) |

||||||||

(In millions, except per share amounts) |

||||||||

|

|

|||||||

|

Nine months ended July 31, |

|||||||

|

2019 |

|

2018 |

|||||

Net revenue(a) |

$ |

21,920 |

|

|

$ |

22,906 |

|

|

Costs and expenses: |

|

|

|

|||||

Cost of sales |

14,820 |

|

|

16,114 |

|

|||

Research and development |

1,404 |

|

|

1,227 |

|

|||

Selling, general and administrative |

3,678 |

|

|

3,684 |

|

|||

Amortization of intangible assets |

199 |

|

|

222 |

|

|||

Restructuring charges |

— |

|

|

14 |

|

|||

Transformation costs |

302 |

|

|

491 |

|

|||

Disaster charges |

(7 |

) |

|

— |

|

|||

Acquisition, disposition and other related charges(b) |

710 |

|

|

70 |

|

|||

Total costs and expenses |

21,106 |

|

|

21,822 |

|

|||

Earnings from continuing operations |

814 |

|

|

1,084 |

|

|||

Interest and other, net |

(139 |

) |

|

(163 |

) |

|||

Tax indemnification adjustments(c) |

89 |

|

|

(1,342 |

) |

|||

Non-service net periodic benefit credit(d) |

45 |

|

|

90 |

|

|||

Earnings from equity interests |

21 |

|

|

23 |

|

|||

Earnings (loss) from continuing operations before taxes |

830 |

|

|

(308 |

) |

|||

(Provision) benefit for taxes(e) |

(261 |

) |

|

3,092 |

|

|||

Net earnings from continuing operations |

569 |

|

|

2,784 |

|

|||

Net loss from discontinued operations |

— |

|

|

(119 |

) |

|||

Net earnings |

$ |

569 |

|

|

$ |

2,665 |

|

|

Net earnings (loss) per share: |

|

|

|

|||||

Basic |

|

|

|

|||||

Continuing operations |

$ |

0.42 |

|

|

$ |

1.79 |

|

|

Discontinued operations |

— |

|

|

(0.07 |

) |

|||

Total basic net earnings per share |

$ |

0.42 |

|

|

$ |

1.72 |

|

|

Diluted |

|

|

|

|||||

Continuing operations |

$ |

0.41 |

|

|

$ |

1.76 |

|

|

Discontinued operations |

— |

|

|

(0.07 |

) |

|||

Total diluted net earnings per share |

$ |

0.41 |

|

|

$ |

1.69 |

|

|

Cash dividends declared per share |

$ |

0.3375 |

|

|

$ |

0.3750 |

|

|

Weighted-average shares used to compute net earnings per share: |

|

|

|

|||||

Basic |

1,367 |

|

|

1,552 |

|

|||

Diluted |

1,380 |

|

|

1,578 |

|

|||

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES |

||||||||||||||||||||||||

ADJUSTMENTS TO GAAP NET EARNINGS, EARNINGS FROM OPERATIONS, |

||||||||||||||||||||||||

OPERATING MARGIN AND DILUTED NET EARNINGS PER SHARE |

||||||||||||||||||||||||

(Unaudited) |

||||||||||||||||||||||||

(In millions, except percentages and per share amounts) |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Three months

|

|

Diluted net

|

|

Three months

|

|

Diluted net

|

|

Three months

|

|

Diluted net

|

|||||||||||||

GAAP net (loss) earnings from continuing operations |

$ |

(27 |

) |

|

$ |

(0.02 |

) |

|

$ |

419 |

|

|

$ |

0.30 |

|

|

$ |

452 |

|

|

$ |

0.29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Amortization of intangible assets |

58 |

|

|

0.04 |

|

|

69 |

|

|

0.05 |

|

|

72 |

|

|

0.05 |

|

|||||||

Restructuring charges(d) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(1 |

) |

|

— |

|

|||||||

Transformation costs(d) |

170 |

|

|

0.13 |

|

|

54 |

|

|

0.04 |

|

|

126 |

|

|

0.08 |

|

|||||||

Disaster charges |

— |

|

|

— |

|

|

(7 |

) |

|

(0.01 |

) |

|

— |

|

|

— |

|

|||||||

Acquisition, disposition and other related charges(b) |

563 |

|

|

0.42 |

|

|

84 |

|

|

0.06 |

|

|

24 |

|

|

0.02 |

|

|||||||

Separation costs(d) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(2 |

) |

|

— |

|

|||||||

Tax indemnification adjustments(c) |

134 |

|

|

0.10 |

|

|

(4 |

) |

|

— |

|

|

(2 |

) |

|

— |

|

|||||||

Non-service net periodic benefit credit(d) |

(12 |

) |

|

(0.01 |

) |

|

(17 |

) |

|

(0.01 |

) |

|

(26 |

) |

|

(0.02 |

) |

|||||||

Loss from equity interests(f) |

38 |

|

|

0.03 |

|

|

38 |

|

|

0.03 |

|

|

38 |

|

|

0.02 |

|

|||||||

Adjustments for taxes(e)(g) |

(321 |

) |

|

(0.24 |

) |

|

(57 |

) |

|

(0.04 |

) |

|

(42 |

) |

|

(0.02 |

) |

|||||||

Non-GAAP net earnings from continuing operations |

$ |

603 |

|

|

$ |

0.45 |

|

|

$ |

579 |

|

|

$ |

0.42 |

|

|

$ |

639 |

|

|

$ |

0.42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

GAAP (loss) earnings from continuing operations |

$ |

(76 |

) |

|

|

|

$ |

434 |

|

|

|

|

$ |

490 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Non-GAAP adjustments related to continuing operations: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Amortization of intangible assets |

58 |

|

|

|

|

69 |

|

|

|

|

72 |

|

|

|

||||||||||

Restructuring charges(d) |

— |

|

|

|

|

— |

|

|

|

|

(1 |

) |

|

|

||||||||||

Transformation costs(d) |

170 |

|

|

|

|

54 |

|

|

|

|

126 |

|

|

|

||||||||||

Disaster charges |

— |

|

|

|

|

(7 |

) |

|

|

|

— |

|

|

|

||||||||||

Acquisition, disposition and other related charges(b) |

563 |

|

|

|

|

84 |

|

|

|

|

24 |

|

|

|

||||||||||

Separation costs(d) |

— |

|

|

|

|

— |

|

|

|

|

(2 |

) |

|

|

||||||||||

Non-GAAP earnings from continuing operations |

$ |

715 |

|

|

|

|

$ |

634 |

|

|

|

|

$ |

709 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

GAAP operating margin from continuing operations |

(1 |

)% |

|

|

|

6 |

% |

|

|

|

6 |

% |

|

|

||||||||||

Non-GAAP adjustments from continuing operations |

11 |

% |

|

|

|

3 |

% |

|

|

|

3 |

% |

|

|

||||||||||

Non-GAAP operating margin from continuing operations |

10 |

% |

|

|

|

9 |

% |

|

|

|

9 |

% |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

GAAP net loss from discontinued operations |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

(1 |

) |

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Non-GAAP adjustments related to discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Adjustments for taxes |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

|

— |

|

|||||||

Non-GAAP net earnings from discontinued operations |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Total GAAP net (loss) earnings |

$ |

(27 |

) |

|

$ |

(0.02 |

) |

|

$ |

419 |

|

|

$ |

0.30 |

|

|

$ |

451 |

|

|

$ |

0.29 |

|

|

Total Non-GAAP net earnings |

$ |

603 |

|

|

$ |

0.45 |

|

|

$ |

579 |

|

|

$ |

0.42 |

|

|

$ |

639 |

|

|

$ |

0.42 |

|

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES |

||||||||||||||||

ADJUSTMENTS TO GAAP NET EARNINGS, EARNINGS FROM OPERATIONS, |

||||||||||||||||

OPERATING MARGIN AND DILUTED NET EARNINGS PER SHARE |

||||||||||||||||

(Unaudited) |

||||||||||||||||

(In millions, except percentages and per share amounts) |

||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||

|

Nine months

|

|

Diluted net

|

|

Nine months

|

|

Diluted net

|

|||||||||

GAAP net earnings from continuing operations |

$ |

569 |

|

|

$ |

0.41 |

|

|

$ |

2,784 |

|

|

$ |

1.76 |

|

|

|

|

|

|

|

|

|

|

|||||||||

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|||||||||

Amortization of intangible assets |

199 |

|

|

0.14 |

|

|

222 |

|

|

0.14 |

|

|||||

Restructuring charges(d) |

— |

|

|

— |

|

|

14 |

|

|

0.01 |

|

|||||

Transformation costs(d) |

302 |

|

|

0.22 |

|

|

491 |

|

|

0.31 |

|

|||||

Disaster charges |

(7 |

) |

|

(0.01 |

) |

|

— |

|

|

— |

|

|||||

Acquisition, disposition and other related charges(b) |

710 |

|

|

0.51 |

|

|

70 |

|

|

0.04 |

|

|||||

Tax indemnification adjustments(c) |

(89 |

) |

|

(0.06 |

) |

|

1,342 |

|

|

0.86 |

|

|||||

Non-service net periodic benefit credit(d) |

(45 |

) |

|

(0.03 |

) |

|

(90 |

) |

|

(0.06 |

) |

|||||

Loss from equity interests(f) |

114 |

|

|

0.08 |

|

|

113 |

|

|

0.07 |

|

|||||

Adjustments for taxes(e)(g) |

19 |

|

|

0.02 |

|

|

(3,281 |

) |

|

(2.07 |

) |

|||||

Non-GAAP net earnings from continuing operations |

$ |

1,772 |

|

|

$ |

1.28 |

|

|

$ |

1,665 |

|

|

$ |

1.06 |

|

|

|

|

|

|

|

|

|

|

|||||||||

GAAP earnings from continuing operations |

$ |

814 |

|

|

|

|

$ |

1,084 |

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||||||

Non-GAAP adjustments related to continuing operations: |

|

|

|

|

|

|

|

|||||||||

Amortization of intangible assets |

199 |

|

|

|

|

222 |

|

|

|

|||||||

Restructuring charges(d) |

— |

|

|

|

|

14 |

|

|

|

|||||||

Transformation costs(d) |

302 |

|

|

|

|

491 |

|

|

|

|||||||

Disaster charges |

(7 |

) |

|

|

|

— |

|

|

|

|||||||

Acquisition, disposition and other related charges(b) |

710 |

|

|

|

|

70 |

|

|

|

|||||||

Non-GAAP earnings from continuing operations |

$ |

2,018 |

|

|

|

|

$ |

1,881 |

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||||||

GAAP operating margin from continuing operations |

4 |

% |

|

|

|

5 |

% |

|

|

|||||||

Non-GAAP adjustments from continuing operations |

5 |

% |

|

|

|

3 |

% |

|

|

|||||||

Non-GAAP operating margin from continuing operations |

9 |

% |

|

|

|

8 |

% |

|

|

|||||||

|

|

|

|

|

|

|

|

|||||||||

GAAP net loss from discontinued operations |

$ |

— |

|

|

$ |

— |

|

|

$ |

(119 |

) |

|

$ |

(0.07 |

) |

|

|

|

|

|

|

|

|

|

|||||||||

Non-GAAP adjustments related to discontinued operations: |

|

|

|

|

|

|

|

|||||||||

Separation costs |

— |

|

|

— |

|

|

51 |

|

|

0.03 |

|

|||||

Tax indemnification adjustments(c) |

— |

|

|

— |

|

|

68 |

|

|

0.04 |

|

|||||

Non-GAAP net earnings from discontinued operations |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|||||||||

Total GAAP net earnings |

$ |

569 |

|

|

$ |

0.41 |

|

|

$ |

2,665 |

|

|

$ |

1.69 |

|

|

Total Non-GAAP net earnings |

$ |

1,772 |

|

|

$ |

1.28 |

|

|

$ |

1,665 |

|

|

$ |

1.06 |

|

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES |

||||||||

CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||||

(Unaudited) |

||||||||

(In millions, except par value) |

||||||||

|

|

|||||||

|

As of |

|||||||

|

July 31, 2019 |

|

October 31, 2018 |

|||||

ASSETS |

|

|

|

|||||

Current assets: |

|

|

|

|||||

Cash and cash equivalents |

$ |

3,693 |

|

|

$ |

4,880 |

|

|

Accounts receivable |

2,965 |

|

|

3,263 |

|

|||

Financing receivables |

3,567 |

|

|

3,396 |

|

|||

Inventory |

2,216 |

|

|

2,447 |

|

|||

Assets held for sale |

52 |

|

|

6 |

|

|||

Other current assets(h) |

2,624 |

|

|

3,280 |

|

|||

Total current assets |

15,117 |

|

|

17,272 |

|

|||

Property, plant and equipment |

6,000 |

|

|

6,138 |

|

|||

Long-term financing receivables and other assets |

9,092 |

|

|

11,359 |

|

|||

Investments in equity interests |

2,346 |

|

|

2,398 |

|

|||

Goodwill and intangible assets |

18,205 |

|

|

18,326 |

|

|||

Total assets |

$ |

50,760 |

|

|

$ |

55,493 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|||||

Current liabilities: |

|

|

|

|||||

Notes payable and short-term borrowings |

$ |

2,207 |

|

|

$ |

2,005 |

|

|

Accounts payable |

5,203 |

|

|

6,092 |

|

|||

Employee compensation and benefits |

1,454 |

|

|

1,412 |

|

|||

Taxes on earnings |

160 |

|

|

378 |

|

|||

Deferred revenue |

3,225 |

|

|

3,177 |

|

|||

Accrued restructuring |

223 |

|

|

294 |

|

|||

Other accrued liabilities |

4,686 |

|

|

3,840 |

|

|||

Total current liabilities |

17,158 |

|

|

17,198 |

|

|||

Long-term debt |

10,453 |

|

|

10,136 |

|

|||

Other non-current liabilities |

5,569 |

|

|

6,885 |

|

|||

Stockholders’ equity |

|

|

|

|||||

HPE stockholders’ equity: |

|

|

|

|||||

Preferred stock, $0.01 par value (300 shares authorized; none issued and outstanding at July 31, 2019) |

— |

|

|

— |

|

|||

Common stock, $0.01 par value (9,600 shares authorized; 1,310 and 1,423 shares issued and outstanding at July 31, 2019 and October 31, 2018, respectively) |

13 |

|

|

14 |

|

|||

Additional paid-in capital |

28,629 |

|

|

30,342 |

|

|||

Accumulated deficit(j) |

(7,959 |

) |

|

(5,899 |

) |

|||

Accumulated other comprehensive loss |

(3,150 |

) |

|

(3,218 |

) |

|||

Total HPE stockholders’ equity |

17,533 |

|

|

21,239 |

|

|||

Non-controlling interests |

47 |

|

|

35 |

|

|||

Total stockholders’ equity |

17,580 |

|

|

21,274 |

|

|||

Total liabilities and stockholders’ equity |

$ |

50,760 |

|

|

$ |

55,493 |

|

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES |

||||||||

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||

(Unaudited) |

||||||||

(In millions) |

||||||||

|

Three months ended

|

|

Nine months ended

|

|||||

Cash flows from operating activities: |

|

|

|

|||||

Net earnings |

$ |

(27 |

) |

|

$ |

569 |

|

|

Adjustments to reconcile net earnings to net cash provided by operating activities: |

|

|

|

|||||

Depreciation and amortization |

632 |

|

|

1,919 |

|

|||

Stock-based compensation expense |

58 |

|

|

207 |

|

|||

Provision for doubtful accounts and inventory |

63 |

|

|

181 |

|

|||

Restructuring charges |

94 |

|

|

146 |

|

|||

Deferred taxes on earnings |

541 |

|

|

885 |

|

|||

Earnings from equity interests |

(3 |

) |

|

(21 |

) |

|||

Dividends received from equity investees |

71 |

|

|

71 |

|

|||

Other, net |

89 |

|

|

134 |

|

|||

Changes in operating assets and liabilities, net of acquisitions: |

|

|

|

|||||

Accounts receivable |

172 |

|

|

315 |

|

|||

Financing receivables |

(293 |

) |

|

(325 |

) |

|||

Inventory |

(87 |

) |

|

66 |

|

|||

Accounts payable |

(261 |

) |

|

(826 |

) |

|||

Taxes on earnings |

(936 |

) |

|

(1,121 |

) |

|||

Restructuring |

(63 |

) |

|

(261 |

) |

|||

Other assets and liabilities |

1,146 |

|

|

626 |

|

|||

Net cash provided by operating activities |

1,196 |

|

|

2,565 |

|

|||

Cash flows from investing activities: |

|

|

|

|||||

Investment in property, plant and equipment |

(625 |

) |

|

(2,153 |

) |

|||

Proceeds from sale of property, plant and equipment |

77 |

|

|

448 |

|

|||

Purchases of available-for-sale securities and other investments |

(8 |

) |

|

(33 |

) |

|||

Maturities and sales of available-for-sale securities and other investments |

10 |

|

|

12 |

|

|||

Financial collateral posted |

(17 |

) |

|

(332 |

) |

|||

Financial collateral returned |

233 |

|

|

740 |

|

|||

Payments made in connection with business acquisitions, net of cash acquired |

(5 |

) |

|

(81 |

) |

|||

Net cash used in investing activities |

(335 |

) |

|

(1,399 |

) |

|||

Cash flows from financing activities: |

|

|

|

|||||

Short-term borrowings with original maturities less than 90 days, net |

— |

|

|

25 |

|

|||

Proceeds from debt, net of issuance costs |

385 |

|

|

1,010 |

|

|||

Payment of debt |

(312 |

) |

|

(872 |

) |

|||

Net proceeds related to stock-based award activities |

15 |

|

|

24 |

|

|||

Repurchase of common stock |

(577 |

) |

|

(1,965 |

) |

|||

Cash dividends paid |

(150 |

) |

|

(461 |

) |

|||

Net cash used in financing activities |

(639 |

) |

|

(2,239 |

) |

|||

Increase (decrease) in cash, cash equivalents and restricted cash |

222 |

|

|

(1,073 |

) |

|||

Cash, cash equivalents and restricted cash at beginning of period |

3,789 |

|

|

5,084 |

|

|||

Cash, cash equivalents and restricted cash at end of period(h) |

$ |

4,011 |

|

|

$ |

4,011 |

|

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES |

||||||||||||

SEGMENT INFORMATION |

||||||||||||

(Unaudited) |

||||||||||||

(In millions) |

||||||||||||

|

|

|

||||||||||

|

|

Three months ended |

||||||||||

|

|

July 31,

|

|

April 30,

|

|

July 31,

|

||||||

Net revenue:(a)(i) |

|

|

|

|

|

|

||||||

Hybrid IT |

|

$ |

5,549 |

|

|

$ |

5,636 |

|

|

$ |

6,109 |

|

Intelligent Edge |

|

762 |

|

|

666 |

|

|

785 |

|

|||

Financial Services |

|

888 |

|

|

896 |

|

|

928 |

|

|||

Corporate Investments |

|

130 |

|

|

125 |

|

|

134 |

|

|||

Total segment net revenue |

|

7,329 |

|

|

7,323 |

|

|

7,956 |

|

|||

Elimination of intersegment net revenue and other |

|

(112 |

) |

|

(173 |

) |

|

(192 |

) |

|||

Total Hewlett Packard Enterprise consolidated net revenue |

|

$ |

7,217 |

|

|

$ |

7,150 |

|

|

$ |

7,764 |

|

|

|

|

|

|

|

|

||||||

Earnings from continuing operations before taxes:(d)(i) |

|

|

|

|

|

|

||||||

Hybrid IT |

|

$ |

704 |

|

|

$ |

645 |

|

|

$ |

624 |

|

Intelligent Edge |

|

37 |

|

|

20 |

|

|

101 |

|

|||

Financial Services |

|

77 |

|

|

77 |

|

|

72 |

|

|||

Corporate Investments |

|

(25 |

) |

|

(29 |

) |

|

(25 |

) |

|||

Total segment earnings from operations |

|

793 |

|

|

713 |

|

|

772 |

|

|||

|

|

|

|

|

|

|

||||||

Unallocated corporate costs and eliminations(d) |

|

(65 |

) |

|

(64 |

) |

|

(49 |

) |

|||

Unallocated stock-based compensation expense |

|

(13 |

) |

|

(15 |

) |

|

(14 |

) |

|||

Amortization of intangible assets |

|

(58 |

) |

|

(69 |

) |

|

(72 |

) |

|||

Restructuring charges(d) |

|

— |

|

|

— |

|

|

1 |

|

|||

Transformation costs(d) |

|

(170 |

) |

|

(54 |

) |

|

(126 |

) |

|||

Disaster charges |

|

— |

|

|

7 |

|

|

— |

|

|||

Acquisition, disposition and other related charges(b) |

|

(563 |

) |

|

(84 |

) |

|

(24 |

) |

|||

Separation costs(d) |

|

— |

|

|

— |

|

|

2 |

|

|||

Interest and other, net |

|

(70 |

) |

|

(18 |

) |

|

(64 |

) |

|||

Tax indemnification adjustments(c) |

|

(134 |

) |

|

4 |

|

|

2 |

|

|||

Non-service net periodic benefit credit(d) |

|

12 |

|

|

17 |

|

|

26 |

|

|||

Earnings from equity interests |

|

3 |

|

|

3 |

|

|

11 |

|

|||

Total Hewlett Packard Enterprise consolidated (loss) earnings from continuing operations before taxes |

|

$ |

(265 |

) |

|

$ |

440 |

|

|

$ |

465 |

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES |

||||||||

SEGMENT INFORMATION |

||||||||

(Unaudited) |

||||||||

(In millions) |

||||||||

|

|

|

||||||

|

|

Nine months ended July 31, |

||||||

|

|

2019 |

|

2018 |

||||

Net revenue:(a)(i) |

|

|

|

|

||||

Hybrid IT |

|

$ |

17,155 |

|

|

$ |

18,160 |

|

Intelligent Edge |

|

2,114 |

|

|

2,147 |

|

||

Financial Services |

|

2,703 |

|

|

2,732 |

|

||

Corporate Investments |

|

373 |

|

|

404 |

|

||

Total segment net revenue |

|

22,345 |

|

|

23,443 |

|

||

Elimination of intersegment net revenue and other |

|

(425 |

) |

|

(537 |

) |

||

Total Hewlett Packard Enterprise consolidated net revenue |

|

$ |

21,920 |

|

|

$ |

22,906 |

|

|

|

|

|

|

||||

Earnings from continuing operations before taxes:(d)(i) |

|

|

|

|

||||

Hybrid IT |

|

$ |

2,024 |

|

|

$ |

1,787 |

|

Intelligent Edge |

|

66 |

|

|

191 |

|

||

Financial Services |

|

231 |

|

|

215 |

|

||

Corporate Investments |

|

(82 |

) |

|

(79 |

) |

||

Total segment earnings from operations |

|

2,239 |

|

|

2,114 |

|

||

|

|

|

|

|

||||

Unallocated corporate costs and eliminations(d) |

|

(179 |

) |

|

(169 |

) |

||

Unallocated stock-based compensation expense |

|

(42 |

) |

|

(64 |

) |

||

Amortization of intangible assets |

|

(199 |

) |

|

(222 |

) |

||

Restructuring charges(d) |

|

— |

|

|

(14 |

) |

||

Transformation costs(d) |

|

(302 |

) |

|

(491 |

) |

||

Disaster charges |

|

7 |

|

|

— |

|

||

Acquisition, disposition and other related charges(b) |

|

(710 |

) |

|

(70 |

) |

||

Interest and other, net |

|

(139 |

) |

|

(163 |

) |

||

Tax indemnification adjustments(c) |

|

89 |

|

|

(1,342 |

) |

||

Non-service net periodic benefit credit(d) |

|

45 |

|

|

90 |

|

||

Earnings from equity interests |

|

21 |

|

|

23 |

|

||

Total Hewlett Packard Enterprise consolidated earnings (loss) from continuing operations before taxes |

|

$ |

830 |

|

|

$ |

(308 |

) |

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES |

||||||||||||||||||

SEGMENT/BUSINESS UNIT INFORMATION |

||||||||||||||||||

(Unaudited) |

||||||||||||||||||

(In millions, except percentages) |

||||||||||||||||||

|

|

|

|

|||||||||||||||

|

Three months ended |

|

Change (%) |

|||||||||||||||

|

July 31,

|

|

April 30,

|

|

July 31,

|

|

Q/Q |

|

Y/Y |

|||||||||

Net revenue:(a)(i) |

|

|

|

|

|

|

|

|

|

|||||||||

Hybrid IT |

|

|

|

|

|

|

|

|

|

|||||||||

Hybrid IT Product |

|

|

|

|

|

|

|

|

|

|||||||||

Compute |

$ |

3,151 |

|

|

$ |

3,093 |

|

|

$ |

3,569 |

|

|

2 |

% |

|

(12 |

%) |

|

Storage |

844 |

|

|

942 |

|

|

887 |

|

|

(10 |

%) |

|

(5 |

%) |

||||

Total Hybrid IT Product |

3,995 |

|

|

4,035 |

|

|

4,456 |

|

|

(1 |

%) |

|

(10 |

%) |

||||

HPE Pointnext |

1,554 |

|

|

1,601 |

|

|

1,653 |

|

|

(3 |

%) |

|

(6 |

%) |

||||

Total Hybrid IT |

5,549 |

|

|

5,636 |

|

|

6,109 |

|

|

(2 |

%) |

|

(9 |

%) |

||||

Intelligent Edge |

|

|

|

|

|

|

|

|

|

|||||||||

HPE Aruba Product |

668 |

|

|

577 |

|

|

703 |

|

|

16 |

% |

|

(5 |

%) |

||||

HPE Aruba Services |

94 |

|

|

89 |

|

|

82 |

|

|

6 |

% |

|

15 |

% |

||||

Total Intelligent Edge |

762 |

|

|

666 |

|

|

785 |

|

|

14 |

% |

|

(3 |

%) |

||||

Financial Services |

888 |

|

|

896 |

|

|

928 |

|

|

(1 |

%) |

|

(4 |

%) |

||||

Corporate Investments |

130 |

|

|

125 |

|

|

134 |

|

|

4 |

% |

|

(3 |

%) |

||||

Total segment net revenue |

7,329 |

|

|

7,323 |

|

|

7,956 |

|

|

— |

% |

|

(8 |

%) |

||||

Elimination of intersegment net revenue and other |

(112 |

) |

|

(173 |

) |

|

(192 |

) |

|

(35 |

%) |

|

(42 |

%) |

||||

Total Hewlett Packard Enterprise consolidated net revenue |

$ |

7,217 |

|

|

$ |

7,150 |

|

|

$ |

7,764 |

|

|

1 |

% |

|

(7 |

%) |

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES |

|||||||||||

SEGMENT/BUSINESS UNIT INFORMATION |

|||||||||||

(Unaudited) |

|||||||||||

(In millions, except percentages) |

|||||||||||

|

|

||||||||||

|

Nine months ended July 31, |

||||||||||

|

2019 |

|

2018 |

|

Y/Y |

||||||

Net revenue:(a)(i) |

|

|

|

|

|

||||||

Hybrid IT |

|

|

|

|

|

||||||

Hybrid IT Product |

|

|

|

|

|

||||||

Compute |

$ |

9,646 |

|

|

$ |

10,350 |

|

|

(7 |

%) |

|

Storage |

2,761 |

|

|

2,747 |

|

|

1 |

% |

|||

Total Hybrid IT Product |

12,407 |

|

|

13,097 |

|

|

(5 |

%) |

|||

HPE Pointnext |

4,748 |

|

|

5,063 |

|

|

(6 |

%) |

|||

Total Hybrid IT |

17,155 |

|

|

18,160 |

|

|

(6 |

%) |

|||

Intelligent Edge |

|

|

|

|

|

||||||

HPE Aruba Product |

1,842 |

|

|

1,914 |

|

|

(4 |

%) |

|||

HPE Aruba Services |

272 |

|

|

233 |

|

|

17 |

% |

|||

Total Intelligent Edge |

2,114 |

|

|

2,147 |

|

|

(2 |

%) |

|||

Financial Services |

2,703 |

|

|

2,732 |

|

|

(1 |

%) |

|||

Corporate Investments |

373 |

|

|

404 |

|

|

(8 |

%) |

|||

Total segment net revenue |

22,345 |

|

|

23,443 |

|

|

(5 |

%) |

|||

Elimination of intersegment net revenue and other |

(425 |

) |

|

(537 |

) |

|

(21 |

%) |

|||

Total Hewlett Packard Enterprise consolidated net revenue |

$ |

21,920 |

|

|

$ |

22,906 |

|

|

(4 |

%) |

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES |

|||||||

SEGMENT OPERATING MARGIN SUMMARY DATA |

|||||||

(Unaudited) |

|||||||

|

|

|

|

|

|||

|

|

Three months ended |

|

Change in Operating

|

|||

|

|

July 31, 2019 |

|

Q/Q |

|

Y/Y |

|

Segment operating margin:(d)(i) |

|

|

|

|

|

|

|

Hybrid IT |

|

12.7 |

% |

|

1.3 pts |

|

2.5 pts |

Intelligent Edge |

|

4.9 |

% |

|

1.9 pts |

|

(8.0) pts |

Financial Services |

|

8.7 |

% |

|

0.1 pts |

|

0.9 pts |

Corporate Investments |

|

(19.2 |

)% |

|

4.0 pts |

|

(0.6) pts |

Total segment operating margin |

|

10.8 |

% |

|

1.1 pts |

|

1.1 pts |

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES |

||||||||||||

CALCULATION OF DILUTED NET EARNINGS (LOSS) PER SHARE |

||||||||||||

(Unaudited) |

||||||||||||

(In millions, except per share amounts) |

||||||||||||

|

Three months ended |

|||||||||||

|

July 31, |

|

April 30, |

|

July 31, |

|||||||

2019 |

|

2019 |

|

2018 |

||||||||

Numerator: |

|

|

|

|

|

|||||||

GAAP net (loss) earnings from continuing operations |

$ |

(27 |

) |

|

$ |

419 |

|

|

$ |

452 |

|

|

GAAP net loss from discontinued operations |

$ |

— |

|

|

$ |

— |

|

|

$ |

(1 |

) |

|

Non-GAAP net earnings from continuing operations |

$ |

603 |

|

|

$ |

579 |

|

|

$ |

639 |

|

|

Non-GAAP net earnings from discontinued operations |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

Denominator: |

|

|

|

|

|

|||||||

Weighted-average shares used to compute basic net earnings per share |

1,334 |

|

|

1,367 |

|

|

1,513 |

|

||||

Dilutive effect of employee stock plans(k) |

— |

|

|

15 |

|

|

18 |

|

||||

Weighted-average shares used to compute diluted net earnings per share |

1,334 |

|

|

1,382 |

|

|

1,531 |

|

||||

GAAP net (loss) earnings per share from continuing operations |

|

|

|

|

|

|||||||

Basic |

$ |

(0.02 |

) |

|

$ |

0.31 |

|

|

$ |

0.30 |

|

|

Diluted(k) |

$ |

(0.02 |

) |

|

$ |

0.30 |

|

|

$ |

0.29 |

|

|

GAAP net loss per share from discontinued operations |

|

|

|

|

|

|||||||

Basic |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

Diluted |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

Non-GAAP net earnings per share from continuing operations |

|

|

|

|

|

|||||||

Basic |

$ |

0.45 |

|

|

$ |

0.42 |

|

|

$ |

0.42 |

|

|

Diluted(l) |

$ |

0.45 |

|

|

$ |

0.42 |

|

|

$ |

0.42 |

|

|

Non-GAAP net earnings per share from discontinued operations |

|

|

|

|

|

|||||||

Basic |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

Diluted |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

Total Hewlett Packard Enterprise GAAP basic net (loss) earnings per share |

$ |

(0.02 |

) |

|

$ |

0.31 |

|

|

$ |

0.30 |

|

|

Total Hewlett Packard Enterprise GAAP diluted net (loss) earnings per share |

$ |

(0.02 |

) |

|

$ |

0.30 |

|

|

$ |

0.29 |

|

|

Total Hewlett Packard Enterprise Non-GAAP basic net earnings per share |

$ |

0.45 |

|

|

$ |

0.42 |

|

|

$ |

0.42 |

|

|

Total Hewlett Packard Enterprise Non-GAAP diluted net earnings per share |

$ |

0.45 |

|

|

$ |

0.42 |

|

|

$ |

0.42 |

|

|

HEWLETT PACKARD ENTERPRISE COMPANY AND SUBSIDIARIES |

||||||||

CALCULATION OF DILUTED NET EARNINGS (LOSS) PER SHARE |

||||||||

(Unaudited) |

||||||||

(In millions, except per share amounts) |

||||||||

|

|

|||||||

|

Nine months ended July 31, |

|||||||

|

2019 |

|

2018 |

|||||

Numerator: |

|

|

|

|||||

GAAP net earnings from continuing operations |

$ |

569 |

|

|

$ |

2,784 |

|

|

GAAP net loss from discontinued operations |

$ |

— |

|

|

$ |

(119 |

) |

|

Non-GAAP net earnings from continuing operations |

$ |

1,772 |

|

|

$ |

1,665 |

|

|

Non-GAAP net earnings from discontinued operations |

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|||||

Denominator: |

|

|

|

|||||

Weighted-average shares used to compute basic net earnings per share |

1,367 |

|

|

1,552 |

|

|||

Dilutive effect of employee stock plans(k) |

13 |

|

|

26 |

|

|||

Weighted-average shares used to compute diluted net earnings per share |

1,380 |

|

|

1,578 |

|

|||

|

|

|

|

|||||

GAAP net earnings per share from continuing operations |

|

|

|

|||||

Basic |

$ |

0.42 |

|

|

$ |

1.79 |

|

|

Diluted(k) |

$ |

0.41 |

|

|

$ |

1.76 |

|

|

|

|

|

|

|||||

GAAP net loss per share from discontinued operations |

|

|

|

|||||

Basic |

$ |

— |

|

|

$ |

(0.07 |

) |

|

Diluted(m) |

$ |

— |

|

|

$ |

(0.07 |

) |

|

|

|

|

|

|||||

Non-GAAP net earnings per share from continuing operations |

|

|

|

|||||

Basic |

$ |

1.30 |

|

|

$ |

1.07 |

|

|

Diluted(l) |

$ |

1.28 |

|

|

$ |

1.06 |

|

|

|

|

|

|

|||||

Non-GAAP net earnings per share from discontinued operations |

|

|

|

|||||

Basic |

$ |

— |

|

|

$ |

— |

|

|

Diluted |

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|||||

Total Hewlett Packard Enterprise GAAP basic net earnings per share |

$ |

0.42 |

|

|

$ |

1.72 |

|

|

Total Hewlett Packard Enterprise GAAP diluted net earnings per share |

$ |

0.41 |

|

|

$ |

1.69 |

|

|

Total Hewlett Packard Enterprise Non-GAAP basic net earnings per share |

$ |

1.30 |

|

|

$ |

1.07 |

|

|

Total Hewlett Packard Enterprise Non-GAAP diluted net earnings per share |

$ |

1.28 |

|

|

$ |

1.06 |

|

|

| (a) | The Company adopted the new revenue recognition accounting standard (ASC 606) on a modified retrospective basis effective the first quarter of fiscal 2019. Fiscal 2019 results are presented under ASC 606, while prior period amounts are not adjusted and continue to be reported under the prior revenue recognition accounting standard (ASC 605). |

|

|

||

| (b) | For the three and nine months ended July 31, 2019, this amount primarily included a charge related to a one-time arbitration settlement. |

|

|

||

| (c) | For the three and nine months ended July 31, 2019, the amount was due primarily from the effective settlement of the U.S. federal income tax audit of fiscal years 2013 through 2015 for HP Inc. The nine month period ended July 31, 2019 also included the effects of U.S. tax reform on tax attributes related to fiscal periods prior to the Separation. |

|

|

||

For the nine months ended July 31, 2018 this amount primarily represents the settlement of certain pre-separation Hewlett-Packard Company income tax liabilities indemnified through the Tax Matters Agreement with HP Inc. |

||

|

||

| (d) | Effective at the beginning of the first quarter of fiscal 2019, subsequent to the adoption of the accounting standards update for retirement benefits (Topic 715), the Company reclassified its non-service net periodic benefit credit from operating expense to other income and expense in its Condensed Consolidated Statements of Earnings. The Company reflected these changes retrospectively, by transferring the non-service net periodic benefit credit, a portion of which was previously allocated to the segments, and the remainder of which was reported within Unallocated corporate costs and eliminations, Transformation costs, Restructuring charges and Separation costs, to Non-service net periodic benefit credit as other income and expense for periods in fiscal 2018. |

|

|

||

These changes had no impact on Hewlett Packard Enterprise's previously reported condensed consolidated GAAP net earnings, non-GAAP net earnings, GAAP net earnings per share, or non-GAAP net earnings per share. |

||

|

||

| (e) | For the three and nine months ended July 31, 2019, the amounts included $308 million and $264 million, respectively, of income tax benefits related to the change in pre- Separation tax liabilities for which the Company shares joint and several liability with HP Inc. and for which the Company is partially indemnified by HP Inc. under the Tax Matters Agreement. The nine month period also included $365 million of income tax charges, related to changes in U.S. federal and state valuation allowances as a result of impacts of the Tax Act and $75 million of income tax benefits on transformation costs and acquisition, disposition and other related charges. |

|

|

||

For the nine months ended July 31, 2018, this amount includes a $2.0 billion benefit in connection with the settlement of certain pre-separation Hewlett-Packard Company income tax liabilities indemnified through the Tax Matters Agreement with HP Inc., a $228 million benefit primarily from foreign tax credits and from the release of non U.S. valuation allowances on deferred taxes established in connection with the Everett Transaction, a $203 million benefit as a result of the liquidation of an insolvent non U.S. subsidiary, and an estimated tax benefit of $1.8 billion from the provisional application of the new tax rules including a lower federal tax rate to deferred tax assets and liabilities, partially offset by a provisional estimate of $1.1 billion of transition tax expense on accumulated non U.S. earnings. |

||

|

||

| (f) | Represents the amortization of basis difference adjustments related to the H3C divestiture. |

|

|

||

| (g) | Effective the first quarter of fiscal 2019, the Company uses a structural tax rate based on long-term non-GAAP financial projections. |

|

|

||

| (h) | The Company adopted the guidance for the classification and presentation of restricted cash in the statement of cash flows in the first quarter of fiscal 2019, beginning November 1, 2018, using the retrospective method. As a result of the adoption of this accounting standard update, as of July 31, 2019, the restricted cash balance included in cash, cash equivalents and restricted cash as disclosed in the Statements of Cash Flows above was $318 million, which was included in Other current assets in the Condensed Consolidated Balance Sheets. |

|

|

||

| (i) | Effective at the beginning of the first quarter of fiscal 2019, the Company implemented organizational changes to align its segment financial reporting more closely with its current business structure. These organizational changes primarily include: (i) the transfer of the data center networking ("DC Networking") business, which was previously reported within the Hybrid IT Product business unit in the Hybrid IT segment, to the HPE Aruba Product and HPE Aruba Services business units within the Intelligent Edge segment; (ii) the transfer of the edge compute business, which was previously reported within the HPE Aruba Product business unit in the Intelligent Edge segment, to the Hybrid IT Product business unit within the Hybrid IT segment; and (iii) the transfer of the Communications and Media Solutions ("CMS") business, which was previously reported within the HPE Pointnext business unit in the Hybrid IT segment, to the Corporate Investments segment. |

|

|

||

The Company reflected these changes to its segment information retrospectively to the earliest period presented, which primarily resulted in the transfer of net revenue and operating profit for each of the businesses as described above. |

||

|

||

These changes had no impact on Hewlett Packard Enterprise's previously reported consolidated net revenue, earnings from operations, net earnings or net earnings per share. |

||

|

||

| (j) | The Company adopted the accounting standard update for income taxes related to intra-entity transfers of assets other than inventory, using the modified retrospective method. As a result, the Company recognized $2.3 billion of income taxes as an adjustment to accumulated deficit in the first quarter of fiscal 2019. |

|

|

||

| (k) | GAAP diluted net earnings per share reflects any dilutive effect of restricted stock awards, stock options and performance-based awards, but the effect is excluded when calculating GAAP diluted net loss per share when it would be anti-dilutive. |

|

|

||

| (l) | Non-GAAP diluted net earnings per share reflects any dilutive effect of restricted stock awards, stock options and performance-based awards. |

|

|

||

| (m) | Earnings/loss per share for discontinued operations was calculated by deducting the earnings per share from continuing operations from the total earnings per share. |

Use of non-GAAP financial measures

To supplement Hewlett Packard Enterprise’s condensed consolidated financial statement information presented on a GAAP basis, Hewlett Packard Enterprise provides revenue on a constant currency basis, non-GAAP operating expenses, non-GAAP operating profit, non-GAAP operating margin, non-GAAP income tax rate, non-GAAP net earnings from continuing operations, non-GAAP net earnings from discontinued operations, non-GAAP diluted net earnings per share from continuing operations, non-GAAP diluted net earnings per share from discontinued operations, gross cash, free cash flow, net capital expenditures, net debt, net cash, operating company net debt and operating company net cash financial measures. Hewlett Packard Enterprise also provides forecasts of non-GAAP diluted net earnings per share and free cash flow.