Gross profit: $1.12 million

Total revenue (Q2): $3.93 million, +29.6% year-over-year

Backlog: $29.8 million

MONTREAL, Aug. 06, 2024 (GLOBE NEWSWIRE) -- PyroGenesis Canada Inc. (http://pyrogenesis.com) (TSX: PYR) (OTCQX: PYRGF) (FRA: 8PY), a high-tech company (the “Company” or “PyroGenesis”) that designs, develops, manufactures and commercializes advanced plasma processes and sustainable solutions which are geared to reduce greenhouse gases (GHG) and address environmental pollutants, is pleased to announce its financial and operational results for the second quarter ended June 30th, 2024.

“With Q2’s strong earnings, PyroGenesis continues its string of positive results reflecting growing industry momentum and customer interest, together with corporate commitment to optimizing expenditures and processes. After posting a three-year low revenue mark back in Q1 2023, we now have posted 5 consecutive quarters of revenue improvement, with four of those quarters, including this most recent, surpassing the previous quarter’s revenue,” said P. Peter Pascali, President and CEO of PyroGenesis.

“The collection of key receivables whose payment timelines were strategically extended, together with a cost reduction program, and the meeting of significant project milestones, resulted in us posting these results. Second-half trends, including the post-quarter end announcement of a large land-based waste-to-energy system design and potential development contract, provides me with the confidence that PyroGenesis will continue to distinguish itself in the industrial decarbonization and electrification arena well beyond 2024.”

KEY Q2 2024 FINANCIAL HIGHLIGHTS

- Revenue of $3.93 million, up 29.6% year-over-year vs. Q2 2023

- An increase of 13% vs. Q1 2024

- 3rd best Q2 revenue in Company’s history

- Backlog of signed and/or awarded contracts of $29.8 million as at August 6, 2024

- Gross margin of 29%

- Net income of $1.4 million, earnings per share of $0.01

SUBSEQUENT EVENTS

- Post quarter end, in July 2024 [news release dated July 22, 2024], the Company announced the closing of a $2.8 million non-brokered private placement consisting of the issuance and sale of 3,505,750 units at a price of $0.80 per unit, for gross proceeds of $2,804,600. Each unit consists if one common share of PyroGenesis, and one common share purchase warrant, entitling the holder to purchase one common share at a price of $1.20 during the twelve months following the closing date of the private placement. Among the subscribers, the CEO and their related parties directly or indirectly purchased in excess of $1 million of this private placement.

- Post quarter end, in July 2024 [news release dated July 03, 2024], the Company announced that up to 4,107,850 common share purchase warrants will be amended such that the exercise price would be reduced to $0.75 per share provided that if the closing price of the common shares exceeds $0.9375 (such amount being 125% of $0.75) over any 5 consecutive trading days, the Company will be entitled to accelerate the expiry date of the warrants to the date that is 30 days following that notice of such acceleration is provided.

- Post quarter end, in July, the Company’s client, HPQ Silicon Inc., announced [news release dated July 30th] the start of commissioning of the Fumed Silica Reactor (FSR) pilot plant for which the Company has been designing, engineering, and constructing a proprietary technology to convert quartz (SiO2) into fumed silica (also known as pyrogenic silica) in a single and eco-friendly step while eliminating the use of harmful chemicals generated by conventional methods. The FSR, if successful, could provide a groundbreaking contribution to the repatriation of silica production to North America. Fumed silica is a moisture-absorbing white microstructure powder with high surface area and low bulk density. Used most often as a thickening agent, anti-caking agent, and stabilizer to improve the texture and consistency of products, the commercial applications of fumed silica can be found in many industries across thousands of product lines, including – but not limited to – personal care, powdered food, pharmaceuticals, agriculture (food & feed), adhesives, paints, sealants, construction, batteries and automotive.

- Post quarter end, the Company announced [news release dated July 29, 2024] the signing of a contract for a land-based waste-to-energy system to a European entity, to transform municipal solid waste into both energy and chemical products. The contract was announced as two phased: phase 1 is a signed $2 million contract for a conceptual and preliminary design phase; phase 2 is the construction and delivery of a final system. Phase 1 is expected to be completed in 2025. Phase 2 is dependent on the client obtaining the required financing and the negotiation of terms and conditions. As noted in the news release, the potential value for this contract grew from approximately $25-$30 million to between $120-160 million, with final decision based on the results of the phase one project, which is scheduled for completion in Q3 2025.

Q2 2024 PRODUCTION AND SALES HIGHLIGHTS

The information below represents highlights from the past quarter for each of the Company’s main business verticals.

Q2 2024 continued the positive revenue growth trend that began in Q2 2023. Q2 2024 marks the 5th straight quarter of revenue improvement compared to the low revenue mark of Q1 2023, with four of those five quarters – including Q2 2024 – surpassing the previous quarter’s revenues.

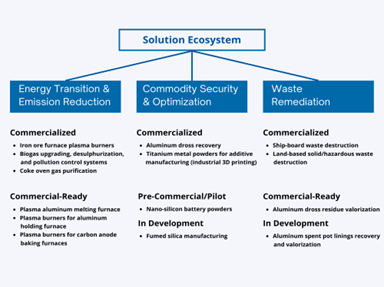

The Company operates within three verticals that align with economic drivers that are key to global heavy industry:

- Energy Transition & Emission Reduction:

- fuel switching – utilizing the Company’s all-electric plasma torches and biogas upgrading technology to help heavy industry reduce fossil fuel use and greenhouse gas emissions,

- Commodity Security & Optimization:

- recovery of viable metals – and optimization of production methods/processes geared to increase output, maximize raw materials and improve availability of critical minerals,

- Waste Remediation:

- safe destruction of hazardous materials – and the recovery and valorization of underlying substances such as chemicals and minerals.

Within each vertical the Company offers solutions at different stages of commercialization.

Energy Transition & Emission Reduction

-

In April, the Company announced a signed letter of intent with global aluminum product manufacturer Constellium for large-scale plasma remelting furnaces, amid an agreement to investigate the potential replacement of fossil fuel burners in Constellium’s furnaces, following the previous completion of successful trials with PyroGenesis that occurred during 2023. With the new agreement, the two companies have agreed to implement an industrial scale aluminum remelting furnace using plasma as the heat source.

-

In April, the Company announced a contract with a global mining supply company, with the agreement related to the client’s intention to examine the use of plasma in decarbonizing its cast houses. The agreement outlined both a test phase and potential on-site initiative that replaces existing fossil fuel burners with the Company’s plasma torches.

-

In April, the Company announced a contract with one of the five largest global steelmakers to assess the applicability of plasma use in primary steel production, specifically during the production of direct reduced iron for use in electric arc furnaces.

-

In May, the Company announced that its wholly-owned subsidiary, Pyro Green-Gas, had signed contracts with a global steel company based in India, for the development and supply of technology to desulphurize and clean the gas that is released during the creation of metallurgical coke from coal. Under the terms of these contracts, Pyro Green-Gas will provide engineering and mechanical solutions that will aid in the removal of hydrogen sulfide from coke oven gas during the coking process. The cleaned gas would then be converted into high value reusable hydrogen.

-

In June , the Company announced that its wholly-owned subsidiary, Pyro Green-Gas, had signed a contract for the engineering, design, and fabrication of a thermal swing adsorption system for the dehydration of pure oxygen produced from electrolyzers at the Varennes Carbon Recycling Plant – a large biofuel production project currently under construction in Varennes, Quebec.

Commodity Security & Optimization