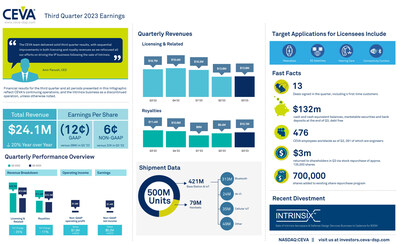

Total revenue for the third quarter of 2023 was $24.1 million, a 20% decrease compared to $30.0 million reported for the third quarter of 2022. Third quarter of 2023 licensing and related revenue was $13.9 million compared to $18.7 million reported for the same quarter a year ago but up 3% sequentially. Royalty revenue for the third quarter of 2023 was $10.1 million, a decrease of 11% when compared to $11.4 million reported for the third quarter of 2022, but up 8% sequentially.

Amir Panush, Chief Executive Officer of CEVA, remarked: "The CEVA team delivered solid third quarter results, with sequential improvements in both licensing and royalty revenues as we refocused all our efforts on driving the IP business following the sale of Intrinsix. In licensing, our wireless communications IPs continue to be in strong demand, underpinned by three more Wi-Fi & Bluetooth combo deals, including a customer for our new Wi-Fi 7 IP for Access Points. In royalties, we reported our second highest CEVA-powered device shipments in a quarter, totaling half a billion units. These results reflect robust restocking demand for consumer devices and illustrative of the strength of our customer base."

During the quarter, thirteen IP license agreements were concluded, targeting a wide variety of end markets and applications, including Wi-Fi 7, Wi-Fi 6 and Bluetooth 5 for connectivity chips targeting access points, smart home automation, smart wearables and single board computers, Bluetooth audio for a global leader in hearing care, and a communications DSP license targeting high-volume satellite communications. Four agreements were with first-time customers and two were with OEM customers.

GAAP gross margin for the third quarter of 2023 was 90% as compared to 81% in the third quarter of 2022. GAAP operating loss for the third quarter of 2023 was $2.7 million, as compared to a GAAP operating loss of $2.4 million for the same period in 2022. GAAP net loss for the third quarter of 2023 was $2.7 million, as compared to a GAAP net loss of $20.6 million reported for the same period in 2022. GAAP diluted losses per share for the third quarter of 2023 was $0.12, as compared to GAAP diluted losses per share of $0.89 for the same period in 2022.

GAAP net loss with the discontinued operations for the third quarter was $5.0 million, as compared to GAAP net loss with the discontinued operations of $22.3 million for the same quarter last year. GAAP diluted losses per share with the discontinued operations for the third quarter of 2023 was $0.21, as compared to GAAP diluted losses per share with the discontinued operations of $0.96 for the same period in 2022.

Non-GAAP gross margin for the third quarter of 2023 was 92%, as compared to 89% for the same period in 2022. Non-GAAP operating income for the third quarter of 2023 was $1.6 million, as compared to Non-GAAP operating income of $7.3 million reported for the third quarter of 2022. Non-GAAP net income and diluted income per share for the third quarter of 2023 were $1.4 million and $0.06, respectively, compared with Non-GAAP net income and diluted income per share of $5.2 million and $0.22, respectively, reported for the third quarter of 2022.

Non-GAAP net income with the discontinued operations for the third quarter of 2023 was $0.4 million, as compared to non-GAAP net income with the discontinued operations of $4.7 million for the same quarter last year. Non-GAAP diluted income per share with the discontinued operations for the third quarter of 2023 was $0.02, as compared to Non-GAAP diluted income per share of $0.20 for the same period in 2022.

Non-GAAP gross margin for the third quarter of 2023 excluded: (a) equity-based compensation expenses of $0.2 million and (b) amortization of acquired intangibles of $0.1 million. Non-GAAP gross margin for the third quarter of 2022 excluded: (a) equity-based compensation expenses of $0.2 million, (b) amortization of acquired intangibles of $0.2 million and (c) impairment charges of $2.0 million relating to discontinued Immervision technology and non-performing assets of certain NB-IoT technology.