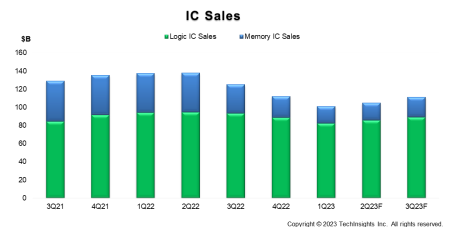

MILPITAS, Calif. – August 15, 2023 – With sequential IC sales declines beginning to moderate, the global semiconductor industry appears to be nearing the end of a downcycle and is expected to begin to recover in 2024, SEMI, in partnership with TechInsights, reported in the Semiconductor Manufacturing Monitor. In Q3 2023, electronics sales are projected to post healthy quarter-on-quarter growth of 10%, while memory IC sales are expected to log double-digit growth for the first time since the downturn started in Q3 2022. Logic IC sales are predicted to remain stable and improve as demand gradually recovers.

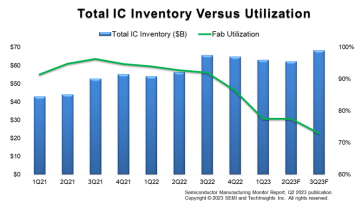

Headwinds will continue for the semiconductor manufacturing sector in the second half of the year, SEMI and TechInsights reported. Drawdowns of high inventory at integrated device manufacturer (IDM) and fabless companies will continue to suppress fab utilization rates to much lower levels than those in the first half of 2023. The weakness is projected to extend declines in capital equipment billings and silicon shipments for the rest of the year despite stable results in the first half of 2023.

Market indicators point to a semiconductor industry bottoming at the end of the first half of 2023, and the industry has since started a recovery, setting the stage for continued growth in 2024. All segments are projected to log year-over-year increases in 2024, with electronics sales surpassing its 2022 peak.

Sources: SEMI ( www.semi.org) and TechInsights ( www.techinsights.com), August 2023

“The slower-than-expected demand recovery will delay the normalization of inventory until the end of 2023, later than we previously anticipated, leading to additional reductions in fab utilization rates in the short term,” said Clark Tseng, Senior Director of Market Intelligence at SEMI. “However, recent trends suggest that the worst is over for ICs. We anticipate semiconductor manufacturing will bottom in Q1 2024.”

“While semiconductor markets have seen a sharp downturn the last four quarters, equipment sales and fab construction have been performing much better than expected,” said Boris Metodiev, Director of Market Analysis at TechInsights. “Government incentives have been driving new fab projects and strong backlogs have helped equipment sales.”

The Semiconductor Manufacturing Monitor (SMM) report provides end-to-end data on the worldwide semiconductor manufacturing industry. The report highlights key trends based on industry indicators including capital equipment, fab capacity, and semiconductor and electronics sales, and includes a capital equipment market forecast. The SMM report also contains two years of quarterly data and a one-quarter outlook for the semiconductor manufacturing supply chain including leading IDM, fabless, foundry, and OSAT companies. An SMM subscription includes quarterly reports.

Download a sample Semiconductor Manufacturing Monitor report.

For more information on the report or to subscribe, please contact the SEMI Market Intelligence Team at mktstats@semi.org. Details on SEMI market data is available at SEMI Market Data.

About SEMI

SEMI® connects more than 2,500 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics design and manufacturing. SEMI members are responsible for the innovations in materials, design, equipment, software, devices, and services that enable smarter, faster, more powerful, and more affordable electronic products. Electronic System Design Alliance (ESD Alliance), FlexTech, the Fab Owners Alliance (FOA), the MEMS & Sensors Industry Group (MSIG), Nano-Bio Materials Consortium (NBMC), and SOI Consortium are SEMI Strategic Technology Communities. Visit

www.semi.org, contact one of our worldwide offices, and connect with SEMI on

LinkedIn and

Twitter to learn more.

Association Contact

Michael Hall/SEMI

Phone: 1.408.943.7988

Email:

mhall@semi.org