All stages of delinquency except for the serious delinquency rate improved over the prior year, signaling improved financial health for borrowers

IRVINE, Calif. — (BUSINESS WIRE) — July 13, 2021 — CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for April 2021.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210713005246/en/

CoreLogic National Overview of Mortgage Loan Performance, featuring April 2021 Data (Graphic: Business Wire)

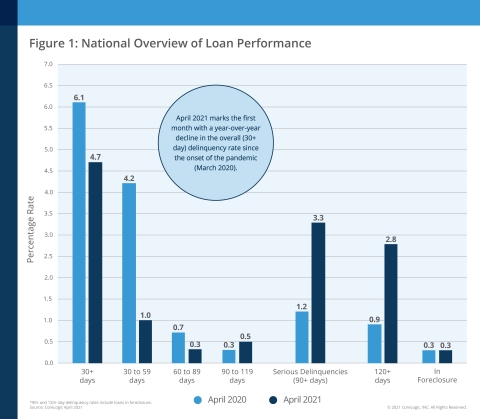

For the month of April, 4.7% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 1.4-percentage point decrease in delinquency compared to April 2020, when it was 6.1%. This month’s overall delinquency marks the lowest rate in a year.

To gain an accurate view of the mortgage market and loan performance health, CoreLogic examines all stages of delinquency. In April 2021, the U.S. delinquency and transition rates, and their year-over-year changes, were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1%, down from 4.2% in April 2020.

- Adverse Delinquency (60 to 89 days past due): 0.3%, down from 0.7% in April 2020.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 3.3%, up from 1.2% in April 2020.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, unchanged from April 2020.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.6%, down from 3.4% in April 2020.

CoreLogic’s data for April 2021 reports its first year-over-year decrease and the lowest overall delinquency rate since the onset of the pandemic as job and income recovery enables more homeowners to remain or return to “current” mortgage payment status. Additionally, in an effort to help borrowers who are in forbearance programs, financial institutions and government entities are continuing to enact provisions that give homeowners ample opportunity to bounce back and keep their homes.

“The sharp rebound in the economy, as well as a potent combination of government fiscal and regulatory help, is fueling unprecedented demand for residential housing and enabling people to buy and stay in their homes,” said Frank Martell, president and CEO of CoreLogic. “The drop in delinquency rates is a further manifestation of the benefits of these tail winds. Barring an unforeseen change, we expect rates to continue to fall and home prices rise over the next 12-to-18 months.”

“Natural hazard events and job loss in the oil and gas industry during the past year continue to affect local delinquency rates, despite a general decline in delinquency rates in many urban areas,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Of all metros, Odessa and Midland, Texas, had the largest one-year jumps in serious delinquency rates, followed by Lake Charles, Louisiana, which was hit hard by Hurricanes Laura and Delta in 2020.”

State and Metro Takeaways:

- In April, nearly all U.S. states logged a decrease in annual overall delinquency rates (only Wyoming experienced a slight increase with a 0.1 percentage-point uptick), and a significant portion of metro areas posted at least a small annual decrease, with only eight experiencing a year-over-year increase.

- Among metros, Odessa, Texas, still recovering from job losses in the oil industry, had the largest annual overall delinquency increase with 2.4 percentage points.

- Other metro areas with significant overall delinquency increases included Midland, Texas (up 2.3 percentage points); Lake Charles, Louisiana (up 0.8 percentage points); Enid, Oklahoma (up 0.7 percentage points) and Casper, Wyoming (up 0.6 percentage points).

The next CoreLogic Loan Performance Insights Report will be released on August 10, 2021, featuring data for May 2021. For ongoing housing trends and data, visit the CoreLogic Intelligence Blog: www.corelogic.com/intelligence.

Methodology

The data in The CoreLogic LPI report represents foreclosure and delinquency activity reported through April 2021. The data in this report accounts for only first liens against a property and does not include secondary liens. The delinquency, transition and foreclosure rates are measured only against homes that have an outstanding mortgage. Homes without mortgage liens are not subject to foreclosure and are, therefore, excluded from the analysis. CoreLogic has approximately 75% coverage of U.S. foreclosure data.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient's parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Amy Brennan at newsmedia@corelogic.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic, the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, buy and protect their homes. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210713005246/en/

Contact:

Amy Brennan

CoreLogic

newsmedia@corelogic.com