— As the Glass Fire burns and threatens Napa Valley, CoreLogic’s 2020 Wildfire Risk Report analyzes both single-family and multifamily homes currently at risk of wildfire damage in the most wildfire-prone states —

IRVINE, Calif. — (BUSINESS WIRE) — September 30, 2020 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released its 2020 Wildfire Risk Report as smoky skies and poor air quality continue to burden cities up and down the West Coast. The report finds 1,975,116 homes1 in the United States with an associated reconstruction cost of more than $638 billion at elevated risk of wildfire damage. These homes are comprised of approximately 6.5% of the total number of single-family residences in these states.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200930005217/en/

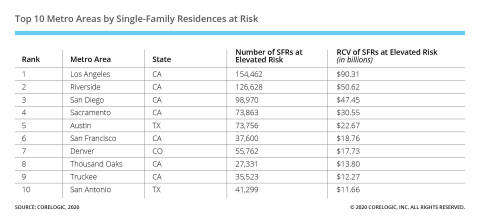

Top 10 Metro Areas by Single-Family Residences at Risk (Graphic: Business Wire)

The Los Angeles metro area tops the list of metropolitan areas with the greatest single-family residences at wildfire risk, followed shortly thereafter by the Riverside and San Diego metro areas. California is home to 76% of these residences on the top 10 list—but the reconstruction cost value of these homes comprise nearly 84% of the list.

“2017 and 2018 were incredibly destructive, record setting years for wildfire, followed by a comparatively quieter 2019. When we talk about wildfire trends, it’s important to treat any decrease in fire activity as only temporary,” says Dr. Tom Jeffery, principal hazard scientist at CoreLogic. “Like most natural hazards, there is no reason to believe that the amount of wildfire acreage, or the number of homes in the path of future wildfires will be any less – and certainly the ongoing 2020 season is proof of that, well on its way to being among the most devastating in recent memory.”

The devastation in Oregon, Washington and California has caused the loss of both dozens of lives and thousands of structures, and recovery from these wildfires is a process that can take years. Both Santa Rosa, home to the Tubbs Fire in 2017, and Paradise, where the Camp Fire took place in 2018, are still in the process of rebuilding. This year, the COVID-19 pandemic has created additional complications to an already deadly peril, and with the potential for disruptions to the supply chain for raw materials, manufacturing and transportation, this effort could be further challenged.

Insurance activities may also be challenged with an influx of claims and fewer adjusters to review damages, making automation and virtualization more critical than ever to supporting policyholders. CoreLogic helps carriers pinpoint fire hazard risk to establish better policy premiums without extensive on-site visits. Virtual surveys and DIY surveys are also less expensive than in-person solutions, providing a cost effective and efficient solution for underwriters and claims adjusters.

“The business landscape is changing to right-size today’s challenges. Wildfire risk presents a case study for this,” says Mick Noland, Executive, General Manager, Insurance Solutions at CoreLogic. “A single event can completely destroy a home. It is critical for insurers to have a complete view of each unique property to ensure adequate coverage and support in the wake of a catastrophe. Next-generation integrated insurance solutions, based on a foundation of granular data and insights, are the key to protecting families and businesses – and ultimately, the health of the housing ecosystem – from the threat of financial catastrophe.”

The CoreLogic Wildfire Risk Report analyzes both single-family and multifamily homes currently at risk of wildfire damage in the most wildfire-prone states, including Alaska, Arizona, California, Colorado, Florida, Idaho, Montana, Nevada, New Mexico, Oklahoma, Oregon, Texas, Utah, Washington and Wyoming. The full report, including maps, charts and images, can be found here.

To follow CoreLogic coverage of ongoing catastrophic events, including wildfires, visit the company’s natural hazard risk information center, Hazard HQ™ at www.hazardhq.com.

Methodology

The CoreLogic Wildfire Risk Score is a deterministic wildfire model which is as comprehensive as it is granular. It covers 15 states: Alaska, Arizona, California, Colorado, Florida, Idaho, Montana, Nevada, New Mexico, Oklahoma, Oregon, Texas, Utah, Washington and Wyoming. It evaluates the risk of a property to wildfire by returning an easy-to-understand, normalized 5 to 100 score, giving insight into the potential risk of a wildfire. It considers slope, aspect, vegetation/fuel, and surface composition as well as proximity to higher risk areas that could affect the property via windblown embers. These factors are all weighted differently and combine to form the score.

Source: CoreLogic

The data provided are for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact newsmedia@corelogic.com or Caitlin New at corelogic@ink-co.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, buy and protect their homes. For more information, please visit www.corelogic.com.

CORELOGIC, the CoreLogic logo and Hazard HQ are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners

1 The risk data in this report is current to April 2020.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200930005217/en/

Contact:

Media Contacts:

Valerie Sheets

Corporate Communications

949-838-5428

newsmedia@corelogic.com

Caitlin New

INK Communications

512-906-9103

corelogic@ink-co.com