- Home prices were up 4.3% in the past year with more gains predicted to come over the next 12 months

- Overall equity for homeowners with mortgages rose 6.6% over the past year providing additional insulation against pandemic impacts

- The number of mortgaged properties with negative equity decreased by 15% in the second quarter of 2020 to 1.7 million or 3.2%

IRVINE, Calif. — (BUSINESS WIRE) — September 21, 2020 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released the Home Equity Report for the second quarter of 2020. The report shows U.S. homeowners with mortgages (which account for roughly 63% of all properties) have seen their equity increase by 6.6% year over year. This represents a collective equity gain of $620 billion, and an average gain of $9,800 per homeowner, since the second quarter of 2019.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200921005128/en/

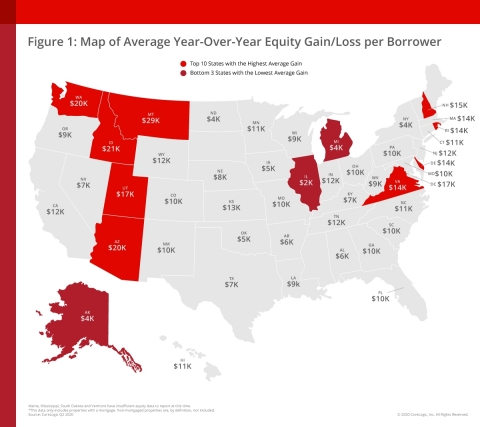

CoreLogic Map of Average Year-over-Year Equity Gain/Loss per Borrower (Graphic: Business Wire)

Despite a cool off in April, home-purchase activity remained strong in the second quarter of 2020 as prospective buyers took advantage of record-low mortgage rates. This, coupled with constricted for-sale inventory, helped drive home prices up and add to borrower equity through June. However, with unemployment expected to remain elevated throughout the remainder of the year, CoreLogic predicts home price growth will slow over the next 12 months and mortgage delinquencies will continue to rise. These factors combined could lead to an increase of distressed-sale inventory, which could put downward pressure on home prices and negatively impact home equity.

“The CoreLogic Home Price Index registered a 4.3% annual rise in prices through June, which supported an increase in home equity,” said Dr. Frank Nothaft, chief economist for CoreLogic. “In our latest forecast, national home price growth will slow to 0.6% in July 2021 with prices declining in 11 states. Thus, home equity gains will be negligible next year, with equity loss expected in several markets.”

“Homeowners’ balance sheets continue to be bolstered by home price appreciation, which in turn mitigated foreclosure pressures,” said Frank Martell, president and CEO of CoreLogic. “Although the exact contours of the economic recovery remain uncertain, we expect current equity gains, fueled by strong demand for available homes, will continue to support homeowners in the near term.”

Negative equity, also referred to as underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are worth. As of the second quarter of 2020, negative equity share, and the quarter-over-quarter and year-over-year changes, were as follows:

- Quarterly change: From the first quarter of 2020 to the second quarter of 2020, the total number of mortgaged homes in negative equity decreased by 5.4% to 1.7 million homes or 3.2% of all mortgaged properties.

- Annual change: In the second quarter of 2019, 2.1 million homes, or 3.8% of all mortgaged properties, were in negative equity. This number decreased by 15% in the second quarter of 2020 to 1.7 million mortgaged properties in negative equity.

- National aggregate value: The national aggregate value of negative equity was approximately $284 billion at the end of the second quarter of 2020. This is down quarter over quarter by approximately $0.7 billion, or 0.2%, from $285 billion in the first quarter of 2020, and down year over year by approximately $20 billion, or 6.6%, from $304 billion in the second quarter of 2019.

Because home equity is affected by home price changes, borrowers with equity positions near (+/-5%) the negative equity cutoff are most likely to move out of or into negative equity as prices change. Looking at the second quarter of 2020 book of mortgages, if home prices increase by 5%, 270,000 homes would regain equity; if home prices decline by 5%, 380,000 would fall underwater.

While national figures reflect a resilient housing market thus far into the recession, equity gains varied broadly on the local level. States with strong home price growth have continued to experience the largest gains in equity. This includes Montana, where homeowners gained an average of $28,900; Idaho, where homeowners gained an average of $21,200, and Washington, where homeowners gained an average of $20,400. Meanwhile, New York, which was hit hard by the pandemic, experienced some of the lowest equity gains (averaging just $4,400) and highest negative equity shares in the second quarter of 2020.

The next CoreLogic Homeowner Equity Report will be released in December 2020, featuring data for Q3 2020. For ongoing housing trends and data, visit the CoreLogic Insights Blog: www.corelogic.com/insights-index.aspx.

Methodology

The amount of equity for each property is determined by comparing the estimated current value of the property against the mortgage debt outstanding (MDO). If the MDO is greater than the estimated value, then the property is determined to be in a negative equity position. If the estimated value is greater than the MDO, then the property is determined to be in a positive equity position. The data is first generated at the property level and aggregated to higher levels of geography. CoreLogic uses public record data as the source of the MDO, which includes more than 50 million first- and second-mortgage liens, and is adjusted for amortization and home equity utilization in order to capture the true level of MDO for each property. Only data for mortgaged residential properties that have a current estimated value are included. There are several states or jurisdictions where the public record, current value or mortgage data coverage is thin and have been excluded from the analysis. These instances account for fewer than 5% of the total U.S. population. The percentage of homeowners with a mortgage is from the 2018 American Community Survey. Data for the previous quarter was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient's parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Valerie Sheets at

newsmedia@corelogic.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE:

CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, buy and protect their homes. For more information, please visit

www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200921005128/en/

Contact:

Media Contact:

Valerie Sheets

CoreLogic

newsmedia@corelogic.com