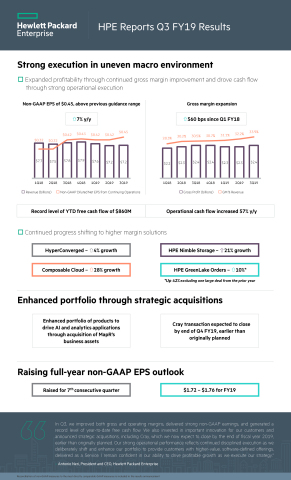

Q3 2019 Financial Highlights:

- Revenue: $7.2 billion

- Gross Margins: 33.9%, up 340 basis points from the prior-year period

-

Diluted Net Earnings Per Share:

- GAAP ($0.02), includes ($0.42) adjustment for a one-time arbitration award to DXC, compared to the previously provided outlook of $0.29 to $0.33 per share

- Non-GAAP $0.45, up 7% from the prior-year period EPS and above the previously provided outlook of $0.40 to $0.44 per share

- Cash Flow from Operations: $1.2 billion, and $2.6 billion year-to-date, up $927 million from the prior-year-to-date period

- Free Cash Flow: $648 million, and $860 million year-to-date, up $790 million from the prior-year-to-date period

FY 2019 Outlook:

- Earnings Per Share: Adjusting GAAP diluted net earnings per share outlook to $0.65 to $0.69 due to a one-time arbitration award to DXC and raising non-GAAP diluted net earnings per share outlook to $1.72 to $1.76

- Free Cash Flow: Reiterating free cash flow guidance of $1.4 to $1.6 billion

SAN JOSE, Calif. — (BUSINESS WIRE) — August 27, 2019 — Hewlett Packard Enterprise (NYSE: HPE) today announced financial results for its fiscal 2019 third quarter, ended July 31, 2019.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190827005771/en/

HPE Q3 FY19 Earnings Results Infographic

“In Q3, we improved both gross and operating margins, delivered strong non-GAAP earnings, and generated a record level of year-to-date free cash flow,” said Antonio Neri, president and CEO of Hewlett Packard Enterprise. “We also invested in important innovation for our customers and announced strategic acquisitions, including Cray, which we now expect to close by the end of fiscal year 2019, earlier than originally planned.”

“Our strong operational performance reflects continued disciplined execution as we deliberately shift and enhance our portfolio to provide customers with higher-value, software-defined offerings, delivered as a Service,” added Neri. “I remain confident in our ability to drive profitable growth as we execute our strategy.”

Third Quarter Fiscal Year 2019

HPE fiscal 2019 third quarter continuing operations financial |

||||||

performance |

||||||

|

Q3 FY19 |

Q3 FY18 |

Y/Y |

|||

GAAP net revenue ($B) |

$7.2 |

|

$7.8 |

|

(7.0%) |

|

GAAP operating margin |

(1.1%) |

|

6.3% |

|

(7.4 pts.) |

|

GAAP net earnings ($B) |

($0.0) |

|

$0.5 |

|

(106%) |

|

GAAP diluted net earnings per share |

($0.02) |

|

$0.29 |

|

(107%) |

|

Non-GAAP operating margin |

9.9% |

|

9.1% |

|

0.8 pts. |

|

Non-GAAP net earnings ($B) |

$0.6 |

|

$0.6 |

|

(5.6%) |

|

Non-GAAP diluted net earnings per share |

$0.45 |

|

$0.42 |

|

7.1% |

|

Cash flow from operations ($B) |

$1.2 |

|

$1.2 |

|

(4.2%) |

|

Information about HPE’s use of non-GAAP financial information is provided under “Use of non-GAAP financial information” below.

Financial Summary

Third quarter net revenue of $7.2 billion, down 7% from the prior-year period, and down 3% from the prior-year period, excluding Tier 1 server sales and adjusted for currency.