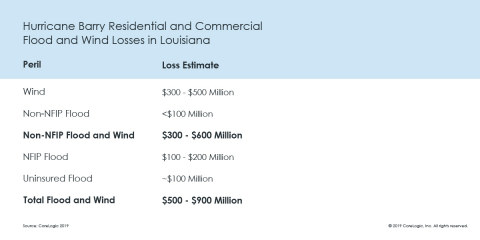

—Non-NFIP Insured Flood and Wind Losses are Between $300 Million and $600 Million—

IRVINE, Calif. — (BUSINESS WIRE) — July 19, 2019 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today announced residential and commercial flood and wind loss estimates for Hurricane Barry. According to this data analysis, flood loss for residential and commercial properties in Louisiana is estimated to be between $200 million and $400 million which includes both storm surge and inland flooding. Insured flood loss from private insurers is estimated at less than $100 million. Wind losses are estimated to be an additional $300 million to $500 million. In total, insured flood and wind losses, excluding National Flood Insurance Program (NFIP) losses, are between $300 million and $600 million.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190719005067/en/

Hurricane Barry Residential and Commercial Flood and Wind Losses in Louisiana; CoreLogic 2019 (Graphic: Business Wire)

Insured residential and commercial flood loss covered by the NFIP is estimated to be between $100 million and $200 million. Uninsured flood loss is estimated to be approximately $100 million. Specifically, less than 20 percent of residential flood loss is uninsured. In Louisiana, approximately 500,000 total residential and commercial property policies are in force through the NFIP. Insured loss represents the amount insurers will pay to cover damages. Unlike wind loss, which is covered by a standard homeowners policy, for residential properties flood is a separate coverage which is not mandatory outside the designated Special Flood Hazard Areas (SFHAs).

This analysis includes residential homes and commercial properties, including contents and business interruption and does not include broader economic loss from the storm. The inland flood analysis is based on the rainfall for 72 hours ending on Monday, July 15, and thus excludes the rainfall from a separate weather system in the days leading up to Hurricane Barry’s landfall.

Visit the CoreLogic natural hazard risk information center, Hazard HQ™, at www.hazardhq.com to get access to the most up-to-date Hurricane Barry storm data and see reports from previous storms.

Methodology

The U.S. Inland Flood Model models all sources of precipitation-driven flooding including riverine, stream, off-plain, and flash flooding. It delivers a comprehensive analytic view of the risk, utilizing widespread coverage of hydrologic and hydraulic data that reflects regional flooding and drainage patterns. As flood risk evolves due to urbanization and change in baseline stream and sea levels, the flood risk methodology from CoreLogic is designed to stay abreast of the latest flood risk data and research, ensuring continuity of risk insights into the future.

The CoreLogic North Atlantic Hurricane Model includes improved location risk and estimation through its robust stochastic event set, high-resolution hazard modeling, component-level vulnerability, and usage of PxPoint™, the structure- and parcel-level geocoding engine. With detailed and rigorously validated model outputs, the model provides the ability to calculate damage contributions from wind and storm surge, providing a transparent way of looking at loss as well as to obtain a better understanding of capital adequacy for the separate or combined perils of hurricane winds and coastal storm surge flooding. The model offers a complete view of the risk for all perils and sub-perils. The North Atlantic Hurricane Model is updated biennially and has been certified by the Florida Commission on Hurricane Loss Projection Methodology (FCHLPM) since the inception of the process in 1997.

The data provided are for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Chad Yoshinaka at Email Contact or Caitlin New at Email Contact. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, acquire and protect their homes. For more information, please visit www.corelogic.com.

CORELOGIC, the CoreLogic logo, PxPoint and Hazard HQ are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190719005067/en/

Contact:

Chad Yoshinaka

Corporate Communications

817-699-4572

Email Contact

Caitlin New

INK Communications

512-906-9103

Email Contact