- 17,000 residential properties regained equity in the first quarter of 2019

- The average homeowner gained $6,400 in home equity during the last year

- 2.2 million residential properties with a mortgage were in negative equity in the first quarter 2019

IRVINE, Calif. — (BUSINESS WIRE) — June 6, 2019 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released the Home Equity Report for the first quarter of 2019. The report shows that U.S. homeowners with mortgages (which account for roughly 63% of all properties) have seen their equity increase by 5.6% year over year, representing a gain of nearly $485.7 billion since the first quarter of 2018.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190606005055/en/

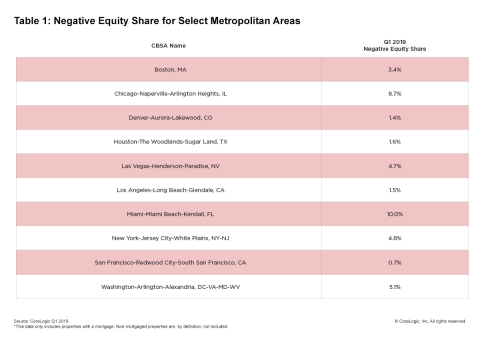

CoreLogic Q1 2019 Negative Equity Share for Select Metropolitan Areas (Graphic: Business Wire)

The average homeowner gained $6,400 in home equity between the first quarter of 2018 and the first quarter of 2019. Some states saw much larger gains. In Nevada, homeowners gained an average of approximately $21,000. In Idaho, homeowners gained an average of approximately $20,700 and Wyoming homeowners gained an average of $20,300 (Figure 1).

From the fourth quarter of 2018 to the first quarter of 2019, the total number of mortgaged homes in negative equity decreased 1% to 2.2 million homes or 4.1% of all mortgaged properties. The number of mortgaged properties in negative equity during the first quarter 2019 fell 11%, or by 268,000 homes, from 2.5 million homes, or 4.7% of all mortgaged properties, from the first quarter 2018.

“A moderation in home-price growth has reduced the gains in home-equity wealth and will likely slow the growth in home-improvement spending in the coming year,” said Dr. Frank Nothaft, chief economist for CoreLogic. “For larger remodeling projects, homeowners often choose to cash-out some of their home equity through a first-lien refinance or placement of a second lien.”

Negative equity, often referred to as being underwater or upside down, applies to borrowers who owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in a home’s value, an increase in mortgage debt or both. Negative equity peaked at 26% of mortgaged residential properties in the fourth quarter of 2009, based on the CoreLogic equity data analysis, which began in the third quarter of 2009.

The national aggregate value of negative equity was approximately $304.4 billion at the end of the first quarter of 2019. This is up approximately $2.5 billion from $301.9 billion in the fourth quarter of 2018 and up year over year by approximately $18 billion from $286.4 billion in the first quarter of 2018.

“The country continues to experience record economic expansion as illustrated by these increases in home equity,” said Frank Martell, president and CEO of CoreLogic. “We expect home equity to continue increasing nationally in 2019, albeit at a slower pace than in recent years.”

For ongoing housing trends and data, visit the CoreLogic Insights Blog: www.corelogic.com/insights-index.aspx.

Methodology

The amount of equity for each property is

determined by comparing the estimated current value of the property

against the mortgage debt outstanding (MDO). If the MDO is greater than

the estimated value, then the property is determined to be in a negative

equity position. If the estimated value is greater than the MDO, then

the property is determined to be in a positive equity position. The data

is first generated at the property level and aggregated to higher levels

of geography. CoreLogic data includes more than 50 million properties

with a mortgage, which accounts for more than 95% of all mortgages in

the U.S. CoreLogic uses public record data as the source of the MDO,

which includes both first-mortgage liens and second liens, and is

adjusted for amortization and home equity utilization in order to

capture the true level of MDO for each property. The calculations are

not based on sampling, but rather on the full data set to avoid

potential adverse selection due to sampling. The current value of the

property is estimated using a suite of proprietary CoreLogic valuation

techniques, including valuation models and the CoreLogic Home Price

Index (HPI). In August 2016, the CoreLogic HPI was enhanced to include

nearly one million additional repeat sales records from proprietary data

sources that provide greater coverage in home price changes nationwide.

The increased coverage is particularly useful in 14 non-disclosure

states. Additionally, a new modeling methodology has been added to the

HPI to weight outlier pairs, ensuring increased consistency and reducing

month-over-month revisions. The use of the enhanced CoreLogic HPI was

implemented with the Q2 2016 Equity report. Only data for mortgaged

residential properties that have a current estimated value are included.

There are several states or jurisdictions where the public record,

current value or mortgage data coverage is thin and have been excluded

from the analysis. These instances account for fewer than 5% of the

total U.S. population. The percentage of homeowners with a mortgage is

from the 2016 American Community Survey. Fourth quarter of 2017 data was

revised. Revisions with public records data are standard, and to ensure

accuracy, CoreLogic incorporates the newly released public data to

provide updated results.