- Elevated delinquency rates persist in some regions impacted by natural disasters

- No state logged an annual gain in its overall delinquency, serious delinquency or foreclosure rate in February

- Overall U.S. foreclosure and delinquency rates were the lowest for a February in at least 20 and 19 years, respectively

IRVINE, Calif. — (BUSINESS WIRE) — May 14, 2019 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report. The report shows, nationally, 4% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in February 2019, representing a 0.8 percentage point decline in the overall delinquency rate compared with February 2018, when it was 4.8%. This was the lowest for the month of February in at least 19 years.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190514005227/en/

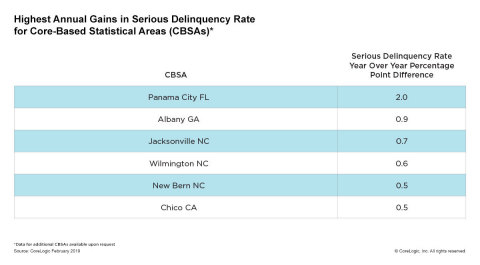

Highest Annual Gains in Serious Delinquency Rate for Core-Based Statistical Areas (CBSAs); CoreLogic February 2019. (Graphic: Business Wire)

As of February 2019, the foreclosure inventory rate – which measures the share of mortgages in some stage of the foreclosure process – was 0.4%, down 0.2 percentage points from February 2018. The February 2019 foreclosure inventory rate tied the November and December 2018 and January 2019 rates as the lowest for any month since at least January 1999.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To monitor mortgage performance comprehensively, CoreLogic examines all stages of delinquency, as well as transition rates, which indicate the percentage of mortgages moving from one stage of delinquency to the next.

The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 2% in February 2019, down from 2.1% in February 2018. The share of mortgages 60 to 89 days past due in February 2019 was 0.6%, down from 0.7% in February 2018. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 1.4% in February 2019, down from 2.1% in February 2018. The serious delinquency rate of 1.4% this February was the lowest for that month since 2001 when it was also 1.4%.

Since early-stage delinquencies can be volatile, CoreLogic also analyzes transition rates. The share of mortgages that transitioned from current to 30 days past due was 1% in February 2019, unchanged from February 2018. By comparison, in January 2007, just before the start of the financial crisis, the current-to-30-day transition rate was 1.2%, while it peaked in November 2008 at 2%.

“The persistently impressive economic expansion continues to drive down housing market distress, with delinquencies and foreclosures hitting near two-decade lows,” said Dr. Ralph McLaughlin, deputy chief economist at CoreLogic. “Furthermore, with unemployment at a 50-year low, wage growth nearing double inflation and a positive demographic structure that will drive housing demand upwards, the future of U.S. housing and mortgage markets look bright even if short term indicators suggest cooling.”

The nation's overall delinquency rate has fallen on a year-over-year basis for the past 14 consecutive months. Fewer delinquencies attribute to the strength of loan vintages in the years since the residential lending market has recovered following the housing crisis. In February, 11 metropolitan areas experienced annual gains – mostly very small – in their serious delinquency rates. The largest gains were in four Southeast metros affected by natural disasters in 2018.

“We are on track to test generational lows as delinquency rates hit their lowest point in almost two decades. Given the economic outlook, we are likely to see more declines over the balance of this year,” said Frank Martell, president and CEO of CoreLogic. “Reflective of the drop in delinquency rates, no state experienced a year-over-year increase in its foreclosure inventory rate so far in 2019.”

The next CoreLogic Loan Performance Insights Report will be released on June 11, 2019, featuring data for March 2019.

For ongoing housing trends and data, visit the CoreLogic Insights Blog: www.corelogic.com/insights.

Methodology

The data in this report represents foreclosure and delinquency activity reported through February 2019.

The data in this report accounts for only first liens against a property and does not include secondary liens. The delinquency, transition and foreclosure rates are measured only against homes that have an outstanding mortgage. Homes without mortgage liens are not typically subject to foreclosure and are, therefore, excluded from the analysis. Approximately one-third of homes nationally are owned outright and do not have a mortgage. CoreLogic has approximately 85% coverage of U.S. foreclosure data.

Source: CoreLogic