- 260,000 Mortgaged Properties Regained Equity Between Q2 2017 and Q3 2017

- The Number of Underwater Homes Decreased Year Over Year by 0.7 Million

- 2.5 Million Residential Properties with a Mortgage Still in Negative Equity

IRVINE, Calif. — (BUSINESS WIRE) — December 7, 2017 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released its Q3 2017 home equity analysis which shows that U.S. homeowners with mortgages (roughly 63 percent of all homeowners*) have collectively seen their equity increase 11.8 percent year over year, representing a gain of $870.6 billion since Q3 2016.

This press release features multimedia. View the full release here: http://www.businesswire.com/news/home/20171207005253/en/

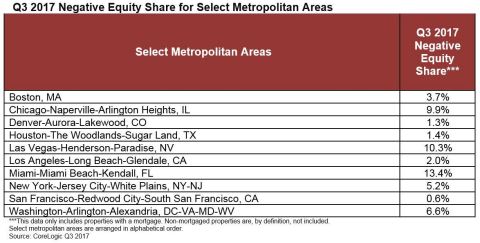

CoreLogic Q3 2017 Negative Equity Share for Select Metropolitan Areas (Graphic: Business Wire)

Additionally, homeowners gained an average of $14,888 in home equity between Q3 2016 and Q3 2017. Western states led the increase, while no state experienced a decrease. Washington homeowners gaining an average of approximately $40,000 in home equity and California homeowners gaining an average of approximately $37,000 in home equity (Figure 1).

On a quarter-over-quarter basis, from Q2 2017** to Q3 2017, the total number of mortgaged homes in negative equity decreased 9 percent to 2.5 million homes, or 4.9 percent of all mortgaged properties. Year over year, negative equity decreased 22 percent from 3.2 million homes, or 6.3 percent of all mortgaged properties, from Q3 2016 to Q3 2017.

“Homeowner equity increased by almost $871 billion over the last 12 months, the largest increase in more than three years,” said Dr. Frank Nothaft, chief economist for CoreLogic. “This increase is primarily a reflection of rising home prices, which drives up home values, leading to an increase in home equity positions and supporting consumer spending.”

Negative equity, often referred to as being “underwater” or “upside down,” applies to borrowers who owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in a home’s value, an increase in mortgage debt or both.

Negative equity peaked at 26 percent of mortgaged residential properties in Q4 2009 based on CoreLogic equity data analysis, which began in Q3 2009.

The national aggregate value of negative equity was approximately $275.7 billion at the end of Q3 2017. This is down quarter over quarter by approximately $9.1 billion, or 3.2 percent, from $284.8 billion in Q2 2017 and down year over year by approximately $9.5 billion, or 3.3 percent, from $285.2 billion in Q3 2016.

“While homeowner equity is rising nationally, there are wide disparities by geography,” said Frank Martell, president and CEO of CoreLogic. “Hot markets like San Francisco, Seattle and Denver boast very high levels of increased home equity. However, some markets are lagging behind due to weaker economies or lingering effects from the great recession. These include large markets such as Miami, Las Vegas and Chicago, but also many small- and medium-sized markets such as Scranton, Pa. and Akron, Ohio.”

*Homeownership mortgage source: 2016 American Community Survey.

**Q2 2017 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results.

For ongoing housing trends and data, visit the CoreLogic Insights Blog: http://www.corelogic.com/blog.

Methodology

The amount of equity for each property is determined by comparing the

estimated current value of the property against the mortgage debt

outstanding (MDO). If the MDO is greater than the estimated value, then

the property is determined to be in a negative equity position. If the

estimated value is greater than the MDO, then the property is determined

to be in a positive equity position. The data is first generated at the

property level and aggregated to higher levels of geography. CoreLogic

data includes more than 50 million properties with a mortgage, which

accounts for more than 95 percent of all mortgages in the U.S. CoreLogic

uses public record data as the source of the MDO, which includes both

first-mortgage liens and second liens, and is adjusted for amortization

and home equity utilization in order to capture the true level of MDO

for each property. The calculations are not based on sampling, but

rather on the full data set to avoid potential adverse selection due to

sampling. The current value of the property is estimated using a suite

of proprietary CoreLogic valuation techniques, including valuation

models and the CoreLogic Home Price Index (HPI). In August 2016, the

CoreLogic HPI was enhanced to include nearly one million additional

repeat sales records from proprietary data sources that provide greater

coverage in home price changes nationwide. The increased coverage is

particularly useful in 14 non-disclosure states. Additionally, a new

modeling methodology has been added to the HPI to weight outlier pairs,

ensuring increased consistency and reducing month-over-month revisions.

The use of the enhanced CoreLogic HPI was implemented with the Q2 2016

Equity report. Only data for mortgaged residential properties that have

a current estimated value are included. There are several states or

jurisdictions where the public record, current value or mortgage data

coverage is thin and have been excluded from the analysis. These

instances account for fewer than 5 percent of the total U.S. population.