—Credit Risk for Loans in 2017 Comparable to Loans Issued in Early 2000s—

- Increase in Condo Co-op and Investor Shares in Q2 2017 Make Loans Appear Riskier

- Purchase Mortgage Loans Are Still High Quality in Terms of Credit Risk

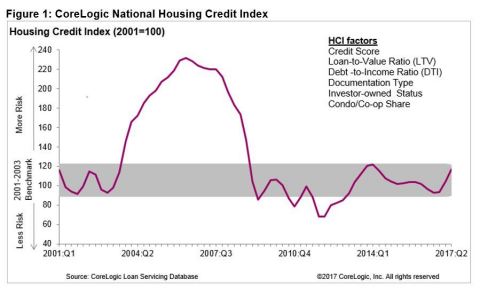

IRVINE, Calif. — (BUSINESS WIRE) — September 28, 2017 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released its Q2 2017 CoreLogic Housing Credit Index (HCI™) which measures trends in six home mortgage credit risk attributes. The HCI indicates the relative increase or decrease in credit risk for new home loan originations compared to prior periods. The six attributes are borrower credit score, debt-to-income ratio (DTI), loan-to-value ratio (LTV), investor-owned status, condo/co-op share and documentation level.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170928005305/en/

Figure 1: CoreLogic National Housing Credit Index Q2 2017 (Graphic: Business Wire)

In Q2 2017, the HCI increased to 117, up 20 points from Q2 2016. Even with this increase, credit risk in Q2 2017 is still within range of the HCI for 2001 to 2003, a timeframe that is considered to be a normal baseline for credit risk. The loosening in the Credit Index during the past quarter was partly due to a shift in the mix of more investor and condominium loans which offset lower-risk signals from the credit score, as well as DTI and LTV attributes.

“Mortgage risk for new originations increased modestly in the second quarter of 2017, but much of this rise was due to a small shift in the mix of loan types to more investor and condominium loans, which have slightly higher risk attributes,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Despite the somewhat higher risk of new origination loans, purchase mortgage underwriting remains relatively clean with an average credit score of 745 and low delinquency risk.”

HCI Highlights for the six Index attributes for Q2 2017:

- Credit Score: The average credit score for homebuyers increased 9 points year over year between Q2 2016 and Q2 2017, rising from 736 to 745. In Q2 2017, the share of homebuyers with credit scores under 640 was 2 percent compared with 25 percent in 2001. In other words, it was less than one-tenth of the share in 2001.

- Debt-to-Income: The average DTI for homebuyers in Q2 2017 was unchanged from Q2 2016 at 36. In Q2 2017, the share of homebuyers with DTIs greater than or equal to 43 percent was 22 percent, down slightly from 25 percent in Q2 2016, but up from 18 percent in 2001.

- Loan-to-Value: The LTV for homebuyers dropped by almost 2 percentage points between Q2 2016 and Q2 2017, down from 87.4 percent to 85.5 percent. In Q2 2017, the share of homebuyers with an LTV greater than or equal to 95 percent had increased by almost half compared with 2001.

- Investor Share: The investor share of home-purchase loans increased from 3.6 percent in Q2 2016 to 4.2 percent in Q2 2017.

- Condo/Co-op Share: The share of home-purchase loans secured by a condominium or co-op building increased from 9.6 percent in Q2 2016 to 11.1 percent in Q2 2017.

- Documentation Type: Low- or no-documentation loans remained a small part of the mortgage market, increasing slightly from 1.5 percent to 1.7 percent of home-purchase loans during the past year.

Figure 1: CoreLogic National Housing Credit Index

Figure 2: Credit Score of Home-Purchase Borrowers (Average and by Percentile)

Figure 3: Averages of Credit Risk Attributes of Home-Purchase Borrowers

Figures 1 through 3 include originations through June 2017 (Q2 2017)

For ongoing housing trends and data, visit the CoreLogic Insights Blog: http://www.corelogic.com/blog.

Methodology

The CoreLogic Housing Credit Index (HCI) measures the variation in mortgage credit risk attributes and uses loan attributes from mortgage loan servicing data that are combined in a principal component analysis (PCA) model. PCA can be used to reduce a complex data set (e.g., mortgage loan characteristics) to a lower dimension to reveal properties that underlie the data set.

The HCI combines six mortgage credit risk attributes, including borrower credit score, loan-to-value (LTV) ratio, debt-to-income (DTI) ratio, documentation level (full documentation of a borrower’s economic conditions or incomplete levels of documentation, including no documentation), status of investor-owned (whether property is a non-owner-occupied investment or owner-occupied primary residence and second home) and property type (whether property is a condominium or co-op). It spans more than 15 years and covers all loan products in both the prime and subprime lending segments and includes all 50 states and the District of Columbia, permitting peak-to-peak and trough-to-trough business cycle comparisons across the U.S. The CoreLogic Loan-Level Market Analytics data includes loan-level information, both current and historical, from servicers on active first-lien mortgages in the U.S., and the Non-Agency Residential Mortgage Backed Securities (RMBS) data includes loan-level information from the securitizers. In addition, CoreLogic public records data for the origination share by loan type (conventional conforming, government, jumbo) were used to adjust the combined servicing and securities data to assure that it reflects primary market shares. These changes across different dimensions are reflected in the HCI. A rising HCI indicates increasing credit risk, while a declining HCI indicates decreasing credit risk.

Source: CoreLogic

The data provided are for use only by the primary recipient or the primary recipient's publication or broadcast. These data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient's parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data are illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or web site. For questions, analysis or interpretation of the data contact Lori Guyton at Email Contact or Bill Campbell at Email Contact. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. These data are compiled from public records, contributory databases and proprietary analytics, and its accuracy depends upon these sources.

About CoreLogic

CoreLogic (NYSE: CLGX) is a leading global property information, analytics and data-enabled solutions provider. The company's combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC, CoreLogic Housing Credit Index (HCI), and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170928005305/en/