—Reconstruction Cost Value of Homes in Extreme-to-Very High Risk Categories Total More Than $8 Billion—

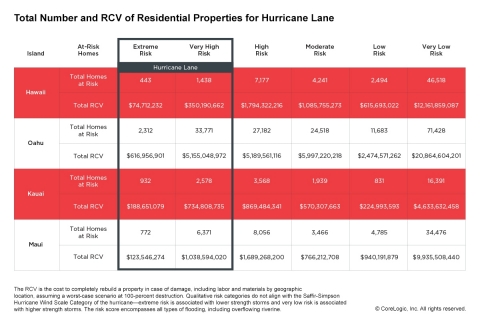

IRVINE, Calif. — (BUSINESS WIRE) — August 22, 2018 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released data analysis showing 48,617 homes in Hawaii with a total reconstruction cost value (RCV) of approximately $8 billion are at extreme-to-very high risk of hurricane-driven flood damage from Hurricane Lane. Based on the National Oceanic and Atmospheric Administration’s (NOAA) predictions, Hurricane Lane is expected to continue to weaken as it approaches the islands. In this analysis, CoreLogic data includes only single-family residential properties likely to be impacted by a lower category storm.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180822005708/en/

CoreLogic Analysis of Total Number and RCV of Residential Properties for Hurricane Lane (Graphic: Business Wire)

The table below shows the total number of properties at risk for all levels of flood damage—from extreme to very low depending on storm size and path—as well as their accompanying RCV totals for the four most populated Hawaiian Islands that could potentially be affected. Due to Hurricane Lane’s weakening projections, the “Extreme” and “Very High Risk” totals are most representative of damage potential.

Visit the CoreLogic natural hazard risk information center, Hazard HQ™, to get access to the most up-to-date Hurricane Lane storm data and see reports from previous storms.

Methodology

The CoreLogic Flood Risk Score (FRS) for this news is based on the detailed hydrologic and hydraulic engineering data from inland watersheds and coastal areas. The impact area delineation is based on the potential impact of storm surge and induced rainfall forecasting from Hurricane Lane. CoreLogic FRS adds new dimensions to flood risk assessment, as compared to legacy flood risk determination technology. Flood Risk Score evaluates flood impact by combining an integrated analysis of the flood area (horizontal dimension), flood elevation (vertical dimension) and comprehensive hydrology (watershed characteristics), providing more granular flood risk classification with FEMA Special Flood Hazard Areas (SFHAs) and beyond. CoreLogic methodology is designed to assess inundation risk for riverine flooding, coastal flooding and flooding from large water bodies (such as ponds and lakes).

Source: CoreLogic

The data provided are for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Alyson Austin at newsmedia@corelogic.com or Caitlin New at corelogic@ink-co.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE: CLGX) is a leading global property information, analytics and data-enabled solutions provider. The company's combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit www.corelogic.com.

CORELOGIC, the CoreLogic logo and Hazard HQ are trademarks of CoreLogic, Inc. and/or its subsidiaries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20180822005708/en/

Contact:

CoreLogic

Alyson Austin

Corporate Communications

949-214-1414

Email Contact

or

INK

Communications

Caitlin New

512-906-9103

Email Contact