- Significant new licensing agreement completed for 5G technology

MOUNTAIN VIEW, Calif., Feb. 13, 2019 — (PRNewswire) — CEVA, Inc. (NASDAQ: CEVA), the leading licensor of signal processing platforms and artificial intelligence processors for smarter, connected devices, today announced its financial results for the fourth quarter and year ended December 31, 2018.

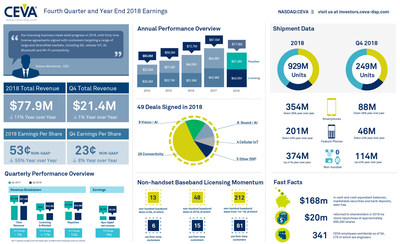

Total revenue for the fourth quarter of 2018 was $21.4 million, a decrease of 1%, when compared to $21.6 million reported for the fourth quarter of 2017. Fourth quarter 2018 licensing and related revenue was $10.5 million, an increase of 17%, when compared to $9.0 million reported for the same quarter a year ago. Royalty revenue for the fourth quarter of 2018 was $10.9 million, a decrease of 14%, when compared to $12.6 million reported for the fourth quarter of 2017, which period included a $0.9 million royalty catch up following an audit of a customer.

Gideon Wertheizer, Chief Executive Officer of CEVA, stated: "We had an excellent fourth quarter in terms of licensing with thirteen agreements signed, including a number of strategic agreements with premier customers. Notably, one agreement with a company targeting the 5G market was one of the largest signed in the company's history. Our fourth quarter royalties came in lower than expected, reflecting softness at a large smartphone OEM, primarily due to the slowing economy in China and lower overall demand for entry-level phones in emerging markets."

Mr. Wertheizer continued: "Our licensing business made solid progress in 2018, with forty nine license agreements signed with customers targeting a range of large and diversified markets, including 5G, cellular IoT, AI, Bluetooth and Wi-Fi connectivity. These new agreements, along with the more than one hundred and forty signed in the previous three years, form the foundation for significant market share expansion and royalty revenue growth in the coming years. Our 2018 royalty business was impacted by the headwinds in the handset market and the slower than originally anticipated expansion at our base station customers. Nevertheless, we continued to strengthen our footprint in our non-baseband markets, with shipments of more than 370 million devices, up 41% year over year. In particular, in the fast-growing Bluetooth space, we shipped in more than 300 million devices in 2018, and are excited by the growth opportunity as that market is expected to exceed 5 billion devices annually by 2022. As we enter 2019, we expect the elevated inventories in handsets to add to the usual seasonal weakness in our near-term royalties. With that said, we do expect continued expansion at our non-handset and base station customers, along with a recovery in handsets in the later part of the year. All in all, we are very excited by the market adoption of our leading-edge technologies in key growth areas, and believe we are on track to more than double our royalty revenue business in 2022."

During the quarter, CEVA completed thirteen license agreements. Seven of the agreements were for CEVA DSP and AI platforms, and six were for CEVA connectivity IPs. All of the licensing agreements signed during the quarter were for non-handset baseband applications and six were with first-time customers of CEVA. Customers' target markets for the licenses include 5G baseband processing, cellular IoT connectivity, advanced consumer and surveillance cameras, automotive connectivity, smart speakers, Bluetooth earbuds, Wi-Fi routers and other IoT devices. Geographically, nine of the deals signed were in China, two were in the U.S., and two were in the APAC region, including Japan.

GAAP net income for the fourth quarter of 2018 decreased 27% to $2.3 million, compared to $3.2 million reported for the same period in 2017. GAAP diluted earnings per share for the fourth quarter of 2018 decreased 29%, to $0.10 from $0.14 a year ago.

Non-GAAP net income and diluted earnings per share for the fourth quarter of 2018 were $5.2 million and $0.23, respectively, representing a 9% and 8% decrease, respectively, over the $5.7 million and $0.25 reported for the fourth quarter of 2017. Non-GAAP net income and diluted earnings per share for the fourth quarter of 2018 excluded: (a) equity-based compensation expense, net of taxes, of $2.0 million, (b) the impact of the amortization of acquired intangibles of $0.3 million associated with the acquisition of RivieraWaves and NB-IoT technologies, and (c) revaluation of investment in other company, net of taxes, of $0.7 million. Net income and diluted earnings per share for the fourth quarter of 2017 excluded: (a) equity-based compensation expense, net of taxes, of $2.3 million, and (b) the impact of the amortization of acquired intangibles of $0.3 million associated with the acquisition of RivieraWaves.

Full Year 2018 Review

Total revenue for 2018 was $77.9 million, a decrease of 11%, when compared to $87.5 million reported for 2017. Licensing and related revenue for 2018 was $40.4 million a decrease of 6%, when compared to $42.9 million reported for 2017. Royalty revenue for 2018 was $37.4 million, representing a decrease of 16%, as compared to $44.6 million reported for 2017.

U.S. GAAP net income and diluted net income per share for 2018 were $0.6 million and $0.03, respectively, a decrease of 97% and 96%, respectively, compared to $17.0 million and $0.75 , respectively reported for 2017.